For centuries, gold coins or bullions has been the go-to asset for those looking to store their wealth and protect themselves against economic uncertainty. But, as the world of finance and investments continues to evolve, new forms of investment assets have emerged, challenging the traditional forms of investing. One of the most significant examples of this is the rise of bitcoin, a digital currency that has disrupted the way we think about money and investing.

Bitcoin is not controlled by any government or institution, and it is transferred and verified using advanced computer systems and algorithms. It is divisible, transferable, and can be stored easily. However, it’s relatively new, and its value is highly volatile. Some argues Bitcoins can be considered to be a safe-haven asset similar to Gold, serving as a hedge against inflation and currency devaluation. But in reality how does bitcoin compare to the tried-and-true gold? In this article, we will explore the differences between these two investment assets and examine how they well they perform as future investment opportunities.

Table of Contents

What is Bitcoin?

Bitcoin is a type of cryptocurrency, which is a digital or virtual currency that uses cryptography for security. Cryptocurrency, in general, is a decentralized form of currency that is not controlled by any government or institution. It is transferred using advanced computer systems. Bitcoin is the first and most well-known cryptocurrency, but there are many other digital currencies available, such as Ethereum, Litecoin, and Ripple – these are collectively known as alt-coins.

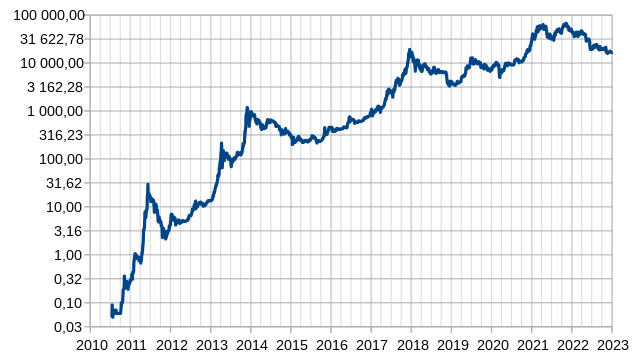

Bitcoin was created in 2009 by an unknown individual or individuals using the name Satoshi Nakamoto. The identity of Satoshi Nakamoto is still unknown. The value of Bitcoin has risen greatly since its creation. When it was first launched, it had no immediate monetary value since it was a completely new and untested concept. The price of a bitcoin on 12th January 2023 (as of writing this article) is $18,165.97 USD. The price of bitcoin has experienced significant fluctuations over the past 14 years.

What is Gold?

Gold is a precious metal that has been used as a form of currency and a store of value for thousands of years. It is widely considered to be a safe-haven asset, i.e., it tends to retain its value during times of economic uncertainty or financial crisis. Gold is a rare earth metal that has very limited supply. There is only about 20% Gold still left to be mined so this rarity is one of the reasons that helps Gold value to rise with time.

As an investment asset, gold is often used as a hedge against inflation, as its value tends to increase when the value of paper fiat currencies decreases. It’s usually an asset that every investor hold in their portfolio. Gold is a safe-haven asset during geopolitical and economic crises, as it is not controlled by any government or institution and is not affected by changes in interest rates or other economic indicators. Gold can be invested in a variety of forms, such as gold coins, bars (bullion), or jewellery. Investing in physical gold is a way to protect against inflation and currency devaluation. But it can be expensive to store and insure, and it’s not easy to liquidate. These pitfalls are easily solved if the world revert back to using the Gold standard, instead of fiat currency monetary system we use today. Some countries are currently exploring on ways to build a new gold backed global reserve currency.

Gold is money. Everything else is credit.

J.P. Morgan

Gold vs. Bitcoin – Comparison

1. Volatility

Bitcoin is highly volatile, meaning its prices can fluctuate dramatically in a short period of time. In 2009, the price of a bitcoin was 0, but in November 2021, it went up to $65,000, the highest recorded price of a bitcoin. Today (12th January 2023), the price of a bitcoin is just $18,213.47. These figures show the volatility of bitcoins and the cryptocurrency market. Volatility can also be seen as an opportunity, as it can present buying opportunities if the price drops, but it also entails high risk. Lack of regulation, uncertainty about the future, and speculation are the main factors that contribute to this volatility. News and media coverage can have a big impact on the price of Bitcoin. Positive news, such as the adoption of Bitcoin by a major company, can drive up its price, while negative news, such as a bankruptcy of a big cryptocurrency exchange (like FTX), can drive it down.

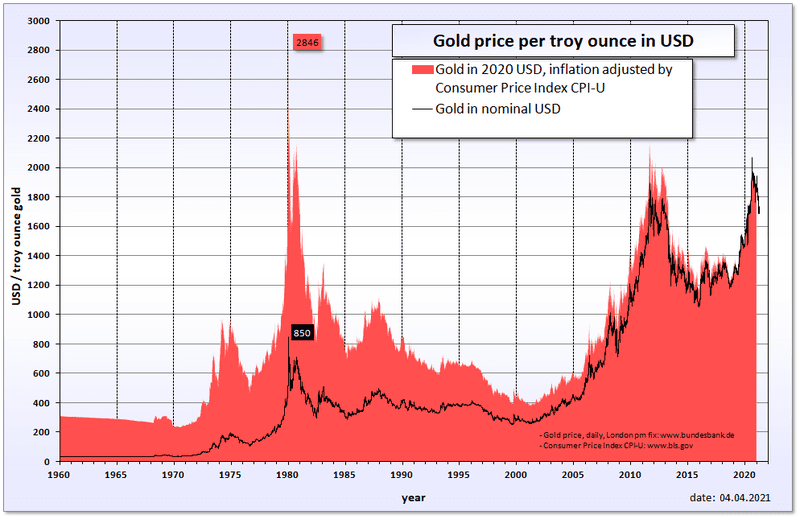

Gold, although it has a limited supply, is less volatile than bitcoin. In 2009, the highest price for an ounce of gold was $1226.60, and in January 2023, the price of an ounce of gold is around $1880. The price of gold usually fluctuates gently over time. Gold is more stable than bitcoin as it has been a matured investment option for a long time.

2. Price Growth

Over the last five years, the price of Bitcoin has increased by 16500%, while the price of gold has only increased by about 40%. When considering this growth in value, bitcoin seems to be a good choice for investments. It has the ability to make you rich overnight (remember, it’s also a high-risk investment).

Meanwhile, gold won’t make you super-rich, but unlike Bitcoin it doesn’t have a downside potential that could wipe out all your paper earnings in an instant.

3. Drop of Value

Gold is a rare metal that has been used as a store of value and a medium of exchange since the times of Romans. It has a tangible physical presence, and its value is based in part on its rarity and industrial uses. Therefore, the value of gold will never drop to zero.

Bitcoin is still in exploration mode, while gold is already an established form of investment Bitcoin is in a bubble as we discussed in our previous article. This means that Bitcoin has a higher chance of a sudden downside, resulting in wiping out your investment. Moreover, if you use popular exchanges to hold bitcoin then there’s chance that they might go bankrupt like in the case of FTX.

4. Liquidity

Both bitcoin and gold are liquid assets (convertibility to cash). But bitcoin is extremely liquid, while physical gold is only moderately liquid. Physical Gold is liquid as in the sense that you can take it anywhere and sell it anytime. You can even sell it over Facebook Marketplace or eBay or in the black market. All the same, it has a lower liquidity than bitcoin. Bitcoin can be sold just with a click of a button for a very small transaction fee. With gold, you have to find a buyer interested in gold or a shop that deals in gold, but you might still not get the spot price for it.

People mainly use Gold as a storer of value so the ability to convert Gold back to cash isn’t a major concern for many gold stackers. There are other ways to get Gold exposure as an investment than having its physical form (coins or bullion). These include buying shares of gold mining companies or gold exchange-traded funds (ETFs), invest in gold by trading options and futures contracts. These forms of investments bypass the liquidly problem of physical Gold. Countries like China and Russia are exploring ways to create Gold backed digital currency which will be aimed to replace US dollar as the global reserve currency.

5. Divisibility

Bitcoin is divisible. The smallest unit of a Bitcoin is called a Satoshi, and it is one hundred millionth of a Bitcoin (0.00000001 BTC). This divisibility allows for flexibility in terms of making transactions and also allows for a wide range of transactions, from buying a cup of coffee to buying a house or a car or even investing or paying bills. On the other hand, Gold is not very divisible. Once you buy a gold coin or a gold bar, even if it’s a fractional portion of gold, you cannot divide it further.

6. Counterfeiting

Gold can be counterfeited, and there are many counterfeiters in the market who sell gold-plated lead bars instead of real gold. Experienced gold investors are generally proficient in identifying real gold from fake gold. But amateur gold investors may find themselves in hot waters with these counterfeits. Bitcoin, on the other hand, is based on a decentralized and digital system, so it is not possible to counterfeit in the traditional sense, where someone creates a copy of a physical object like a dollar bill or coin.

7. Daily Use for Payments

When it comes to transactions, Central bank issued Gold coins are legal tender and has a face value. However, due to safety reason you can’t really carry around gold coins with you to make transactions in daily life.

Bitcoin suppose to solve this problem but due to its highly volatile nature (price/value changes every second) and large fees people have to incur when processing the transactions has hindered its adaptation as a form payment. It’s almost impossible to price things in Bitcoin so we can not expect wide acceptance of it as a legal tender.

8. Security

Gold, as a physical commodity, can be stolen or lost if not stored properly. It is also subject to fraud and forgery. So, it is important to store it in a safe and secure location and insure it, especially if you have a massive amount of gold. On the other hand, Bitcoin, as a digital asset, is more susceptible to hacking and phishing attacks. Hackers may try to gain access to an individual’s digital wallet by guessing or stealing their private key or by tricking them into giving it away through phishing scams.

9. Longevity

Bitcoin has a comparatively short history, as it was introduced only in 2009, but gold has been used as a form of currency for thousands of years. Since bitcoin is a relatively new hyped up concept, there is a chance for the value of bitcoin to go back to zero. However, by looking at the long history of gold as a medium of exchange, it’s highly unlikely that the price of gold will ever go to zero. Even in times of economic downturn or hyperinflation, gold has always maintained a significant level of value.

10. Damage

Most people store bitcoins in a hard drive, specifically a hardware wallet. A hardware wallet is a physical device, similar to a USB drive, that stores your private keys offline. This means that the keys are not stored on a computer connected to the internet, which makes them much more secure against hacking and theft. The downside of hardware wallets is that they can be lost, stolen or damaged. They can be damaged by elements like water, high heat, and dust. Gold, on the other hand, is a very strong and durable metal and is resistant to many forms of damage.

11. Loss and Recovery

Once a bitcoin is lost, it’s not possible to recover it. If the private key associated with a bitcoin wallet is lost, the bitcoins in that wallet will be permanently lost and will be impossible to access or spend. For example, if someone who owns bitcoins dies and the key is not known by others, bitcoins are lost forever.

Gold does not get “lost” in the same way that bitcoins can be lost. Physical gold, such as gold coins or bars, can be lost or stolen, and it can be difficult or impossible to recover it once it is gone. However, gold can also be found again. For example, lost gold mines can be rediscovered, or gold can be recovered from shipwrecks or natural disasters. Also, gold is an element that exists naturally on the earth, so it will never be destroyed or disappear.

12. Technology

To access bitcoins, one has to have access to a computer and the internet. Moreover, investing in bitcoins involves several steps, such as choosing a bitcoin wallet (a place to store the bitcoins) and a cryptocurrency exchange (a platform where you can buy and sell bitcoin). These require a certain level of computer literacy. However, investing in gold does not require technology or electricity. Neither does it require computer skills.

Summary

Both gold and bitcoin have their own advantages and disadvantages. Gold is a trustworthy form of investment that has a long history of maintaining its value. Bitcoin is digital, easily transferable and has the potential for growth as well as significant downside due to the bubble it’s in right now.

Ultimately, the best investment choice depends on your investment goals, risk tolerance, and personal preference. It’s always a good idea to diversify your investment portfolio and consider all the factors before investing in any asset.

Bitcoin is no more digital gold than a photograph of a hamburger is digital food.

Peter Schiff

If you enjoyed this article then you may also like to read our post Are Cryptocurrencies and NFTs digital pyramid schemes based off of Greater fool theory?