Have you ever noticed that the rich are constantly getting richer, no matter the circumstances? How are they doing this exactly? Well, it appears the main reason for the rich getting richer is a phenomenon known as the Cantillon effect, which basically states that money printing will benefit certain parts of the economy more than others. In fact, it will give some people more purchasing power at the expense of others in the economy.

In this article, we will delve into the Cantillon effect and explore how it contributes to wealth inequality. We will discuss the mechanics of this phenomenon, its implications for society, and most importantly, provide insights into what you can do to protect yourself from its effects.

Table of Contents

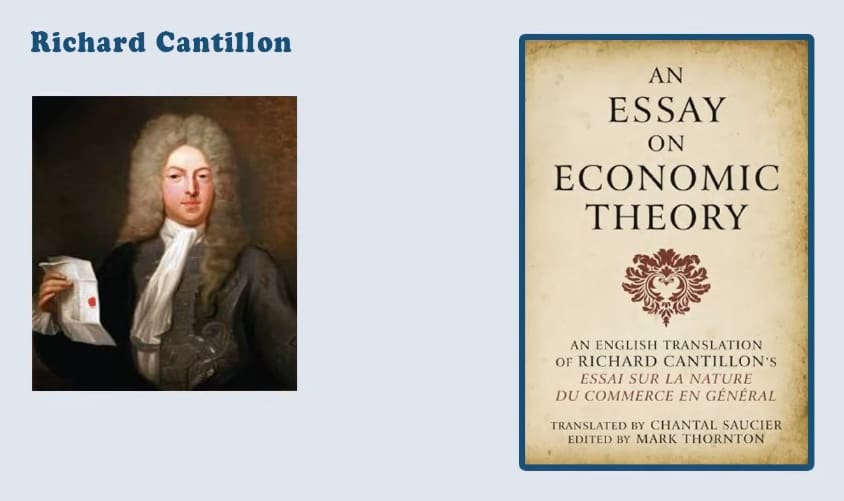

Introduction to Richard Cantillon and the Cantillon Effect

The term Cantillon effect is named after the Irish-French economist and banker Richard Cantillon. His book “Essay on the Nature of Trade in General” (Essai sur la Nature du Commerce en Général), published in 1755, is considered the first complete treatise on economy. It describes many economic concepts, including monetary theories, cause and effect methodology, monetary theories, and the development of spatial economics. In this essay, Cantillon emphasized the pivotal role played by entrepreneurs in driving economic activity. These entrepreneurs are described as a diverse group encompassing traders, innovators, and merchants who are willing to undertake risks in pursuit of profit. The central theme underscores their significance as risk-takers who actively contribute to economic growth and development.

This perspective is crucial to understanding another key aspect of the essay—the non-neutrality of money, often referred to as the Cantillon Effect. This phenomenon delves into the dynamics of how newly created money enters an economy. The individuals or entities responsible for the creation of money play a decisive role in determining when and where it enters the economic landscape. This includes considerations such as which sector or industry it flows into, the intended purposes (such as asset purchases, consumer spending, or business expansion), and, perhaps most significantly, which individuals or entities are the beneficiaries of this newly created money.

What is the Cantillon Effect

The Cantillon effect describes the uneven expansion in the economy when new money is introduced into a system. This effect begins with the introduction of new money to the economy, often by a central authority like a central bank or government. The new money is infused into the economy through various conduits, such as bank loans, governmental expenditures, or central bank acquisitions. However, the transfer of this newfound money is not made uniformly. The money flows through the economy in a tiered structure, and those who acquire it first will have an advantage over all others. Certain individuals and entities, predominantly those closely entwined with the financial system or government, take possession of the money in its infancy. This “first tier” encompasses financial institutions, government beneficiaries, bureaucrats, and those involved in the decision-making process of monetary policy. These individuals utilize this new money to procure assets like financial assets (stocks, bonds), real estate, and commodities.