For centuries gold has been a store of value, coveted for its scarcity and universal acceptance. The popularity of gold is attributed to a unique set of characteristics that makes it exceptionally well-suited for storing and investing.

Firstly, the challenging process of mining gold and extracting it from the ground naturally limits its supply, effectively keeping inflation in check. Additionally, gold’s distinctive color, weight, and malleability make it difficult to counterfeit, ensuring its authenticity. The relative scarcity of gold allows for the storage of significant wealth within a compact space. Moreover, its resistance to corrosion, rust, decay, or rot means that gold can preserve wealth indefinitely, with time posing no threat to its value. All these factors make gold a valuable precious metal investment, especially in times of economic instability. In this article, we’ll discuss various aspects of investing in gold, from the different forms of gold investments to the factors that affect the price of gold.

Table of Contents

Why Invest in Gold?

Our existing monetary system is based on fiat money, which includes currencies like the dollar, pound, euro, and yen. This system relies on ledger money, which is basically digital records of account balances and transactions held by various financial institutions. Therefore, in this system, money is nothing more than a collection of digital lists maintained by different financial institutions.

In traditional banking, the money we deposit can be subject to potential losses in the event of insolvency. An example is the financial crisis Cyprus experienced in 2013. The Cyprus Bank seized a portion of deposited savings above 100,000 Euros, leaving major depositors with significant losses. Such situations emphasize the importance of having tangible assets like gold, which cannot be easily seized or devalued.

There are many advantages of gold. Gold serves as a store of value over time. Gold has historically served as a hedge against inflation. When economies experience high inflation rates, the value of fiat currencies decreases, while the value of gold tends to rise. By owning physical gold, we retain control over our wealth and protect ourselves from the potential depreciation of fiat currencies. The supply of gold is limited, as it is a finite resource. Central banks cannot simply print more gold like they can with paper fiat currencies.

Gold is money. Everything else is credit

J.P. Morgan

Moreover, holding gold in one’s investment portfolio can provide diversification benefits. Gold often exhibits a low or negative correlation with other financial assets, such as stocks and bonds. This means that when other asset classes may be experiencing volatility or downturns, gold can act as a stabilizing force and help mitigate losses.

How to Start Investing in Gold?

The first step in investing in gold is to buy highly recognizable gold bars or coins, such as the Canadian Gold Maple Leaf (GML) coins and gold PAMP bars. By choosing these widely recognized forms of gold bullion, you can ensure both liquidity and ease of trade. American Gold Eagle and the Chinese Gold Panda are also popular with gold collectors but it’s important to consider their premiums. Overpaying for gold coins/bars can significantly reduce potential returns on investment. Finding a balance between recognition and cost-effectiveness is important.

When it comes to investing in gold, there are various options available to suit different requirements. One important aspect to consider is the weight measurement, as gold bullions can be purchased in gram, troy ounce, or tola. It’s also worth noting that gold purity is measured in ‘carats’, with 24ct being the purest form of gold. Additionally, investors have the flexibility to choose from various shapes and sizes when purchasing gold bars. Gold coins are another popular option, commonly available in troy ounces and fractions of that such as half an ounce or quarter of an ounce. To get more money for gold bars or biscuits, buy ones that come with an Assay Card or Certificate of Authenticity (COA). This proves their authenticity and increases their value in the future.

Things You Should Know About Gold Prices

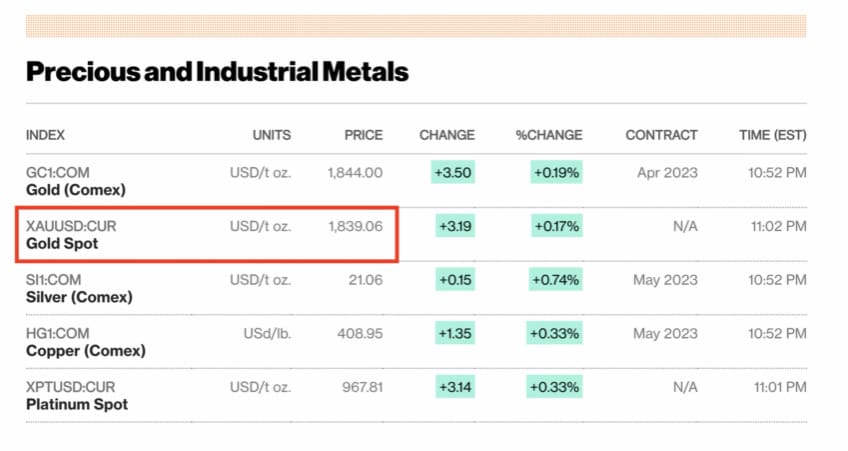

When investing in gold, there are two prices you should know: the spot price of gold and the physical price. The spot price is the price of gold being traded in the Futures Market, also known as paper price. The physical price includes the spot price plus the physical premium.

The physical premium represents the cost of extracting gold from gold mines and refining it into coin and bar forms. You should always try to minimize this premium because it directly impacts the potential return on investment when selling gold. There is no guarantee of recovering the premium when selling your gold, so it’s best to pay the lowest possible premium. Canadian Maples and PAMP bars are generally gold options with low premiums. Another option with a low premium is the gold Britannia coin from the United Kingdom.

Always consider purchasing physical gold in one-ounce or larger increments. Although gold prices may be higher for larger bars, the physical premiums decrease. For example, a one-ounce bar may have a premium of 4%, while a 100-gram bar could have a premium as low as 2%. Opting for larger bars can result in significant savings when steadily building a physical gold portfolio.

Avoid purchasing quarter-ounce coins or one-tenth of a gold coin, as their premiums are unreasonably high, ranging from 10% to 50%. Additionally, decorative coins or bars, such as limited-edition collectibles, often have higher premiums (around 8% to 9%). While they may look appealing, they are more suited for collectors rather than investors.

Why Invest in Gold and Not Silver?

Both gold and silver are precious metals (PMs) and investment options. But it’s important to understand their differences.

Gold has a long history as a primary monetary asset and is known as a good store of value. It is a safe haven during economic uncertainties. In contrast, silver is more closely tied to industrial use, with over 70% of its demand coming from industrial applications in 2021. Some argue that silver is more of an industrial metal than a precious metal. The demand from industries significantly influences the price of gold; therefore, the price of silver is somewhat tied to the global economic outlook.

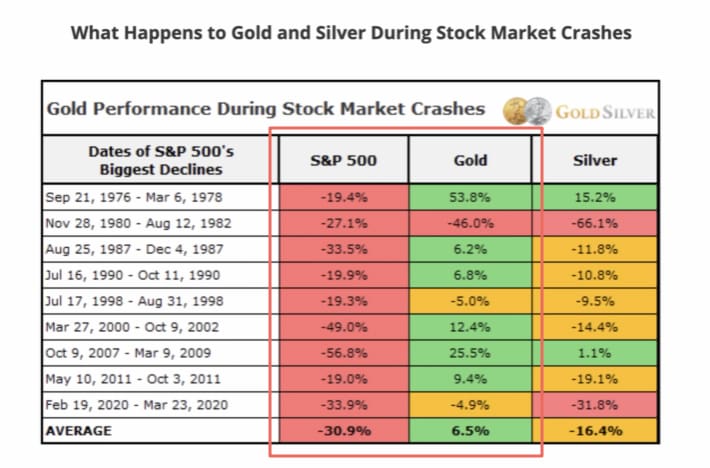

During major stock market crashes, gold has showed its resilience, with an average appreciation of 6.5%, while silver experienced a significant decline of 16.4%. This highlights the contrasting behavior of the two metals. Different factors than those affecting silver influence the price of gold. Therefore, gold tends to hold stronger during market downturns compared to silver.

Another important aspect to consider is the premiums associated with physical silver. Compared to gold, physical silver has higher premiums. While an ounce of physical gold may have a premium of around 3-4%, an ounce of silver tends to have premiums as high as 20% or even 30%, depending on the brand. Selling silver back to dealers may result in the loss of a significant portion of the premium. This difference in premiums adds an additional cost to investing in silver.

What Drives Gold Prices?

Understanding the factors that drive gold prices is essential for investors. Several elements can influence the price of gold, ranging from geopolitical events to supply and demand dynamics.

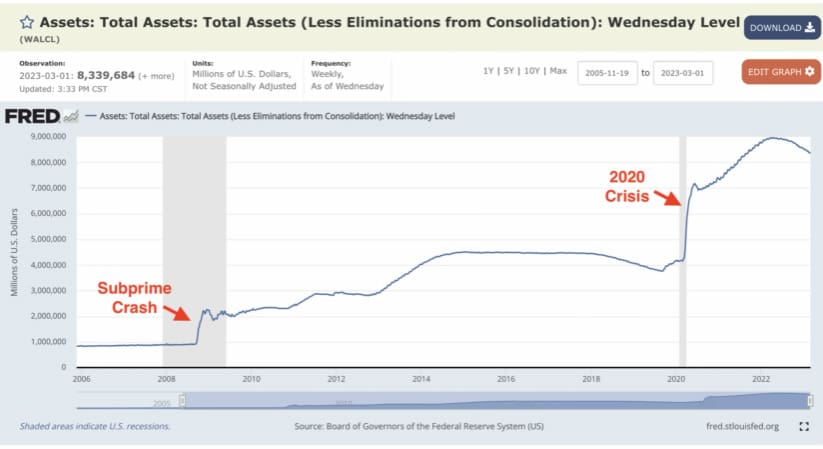

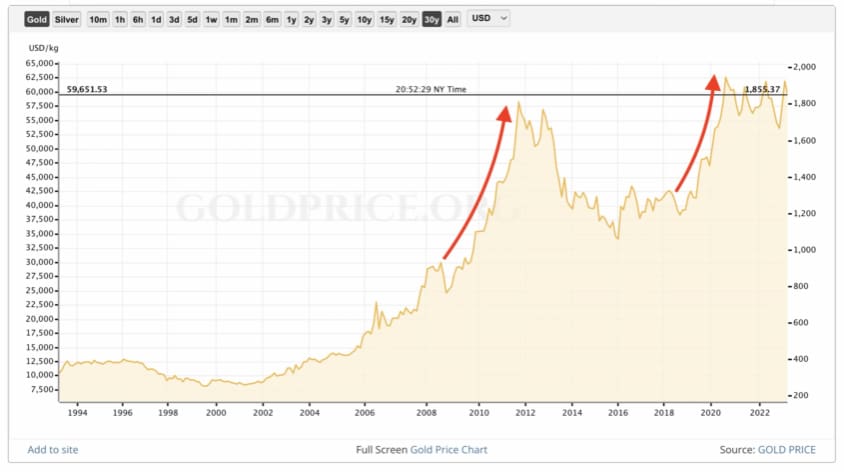

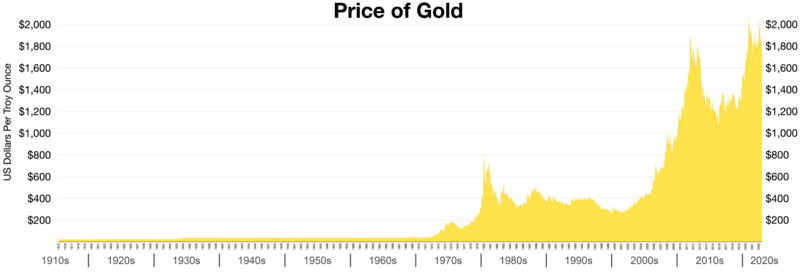

The debasement of global fiat currencies, particularly the U.S. dollar, plays a significant role in the price of gold. As gold is priced in dollars, an increase in the supply of dollars can have an impact on gold prices. For instance, during severe recessions, central banks like the US Federal Reserve may print trillions of dollars to stimulate the economy. COVID-19 stimulus check issuance is one such recent event. Printing money out of thin air and dropping them to the market cause massive inflation that’s detrimental to lower and middle class households. This erratic monetary expansion can erode financial trust in paper fiat system, leading people to seek the safety and value preservation offered by gold. The influx of demand for gold can drive its price upward, as observed by its rise from $700 per ounce to new all-time highs above $2,000.

Another factor that undermines financial trust is excessive deficit spending by governments. When countries engage in deficit spending, they effectively consume future wealth in the present. This approach is often inflationary and can devalue currencies. For example, the U.S. government’s significant deficit spending, financed through issuing bonds and debt monetization, expands the money supply. This can lead to inflation and dilute the purchasing power of the dollar. Consequently, gold prices rise not because gold is inherently becoming more valuable but rather due to the diminishing value of the dollar. In the past century, the dollar has lost around 97% of its purchasing power.

Gold priced in U.S. dollars has a 92% correlation to Total Federal Debt Outstanding since Nixon closed the Gold Window in 1971

OCM Gold Fund

Wars and sanctions can also have a significant impact on the price of gold. During times of war, there is often an increase in inflation due to the excessive printing of money to fund military activities. War consumes resources such as oil and industrial metals, leading to decreased supply and inflationary pressures in various sectors. Consequently, gold prices tend to rise during geopolitical instability, as it serves as a hedge against inflation and uncertainty surrounding normal financial system.

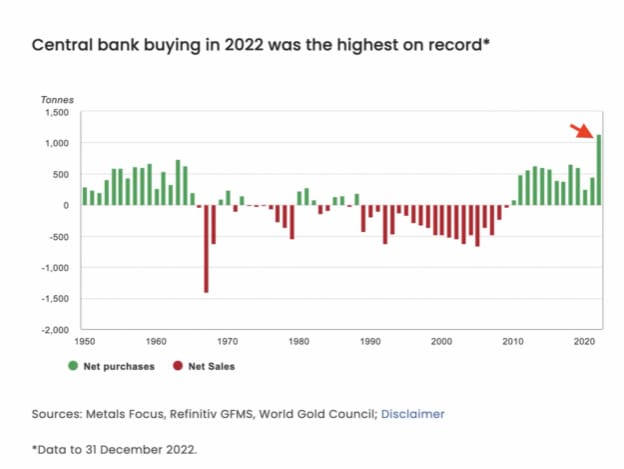

In addition to wars, sanctions can also affect the price of gold. When countries impose sanctions on others, assets can be frozen or confiscated, creating a sense of insecurity and reducing confidence in traditional financial instruments. This realization has led countries, particularly those affected by sanctions, to diversify their holdings and shift towards gold as a reliable store of value. Central banks, in particular, have been increasing their gold reserves in recent years, recognizing gold’s ability to mitigate counterparty risk. For example, when the United States and its allies confiscate Russian central bank assets, it sparked concerns globally. This event highlighted the vulnerability of holding financial assets denominated in US dollar (Like, U.S. Treasury bonds) to involuntary confiscation, violating international contracts and treaties. Central banks around the world, including China, responded by reducing their exposure to U.S. Treasuries and increasing their gold holdings. In 2022, central banks added over 1,100 tons of gold to their reserves, reaching a 55-year high.

The dollar is our currency, but it’s your problem

John Connally – Former US Treasury secretary

The Resurgence of Gold: Why are Central Banks Rapidly Acquiring Gold?

When governing a country, the concept of checks and balances plays a crucial role. In the realm of economics and the financial well-being of a nation, gold reserves act as a check against reckless deficit spending and money printing, which can lead to debt problems and inflation. Such strategies might be employed by a ruling regime as a political ploy to gain votes. Politicians come and go, but the debt they incur to win people over could put entire generations in debt. Bankruptcy of the country Sri Lanka is a good case study for such a situation.

As of this writing, Gold is experiencing a price surge, nearing all-time highs. Central banks have been trying to prevent this surge for a long time (to preserve the value of their fiat paper money), yet they are currently buying gold at a faster pace than in the past 70 years due to the demise of daddy of all fiat currency the US dollar. This trend can be observed by looking at the concentration of gold buying among central banks over the last 30 years. While some central banks sell gold, others are buying it, with Russia, China, Turkey, and India being the biggest buyers.

This recent surge in gold prices follows a pattern seen before, such as in the early 2000s to 2011, when the price of gold experienced a bubble after decades of moving sideways. This previous pattern was also driven by large net central bank gold purchases. The same trend is currently unfolding, indicating the significance of central bank gold purchases in influencing gold price.

According to the World Gold Council, the momentum for central banks buying gold is not slowing down, and 2023 has had the strongest start since at least 2010. The data shows that the net purchases of gold by central banks in the first two months of 2023 have been significant, outweighing any records going back to 1950. This level of gold buying has not been seen for over 70 years, indicating a significant trend. In 1967, a similar surge in gold buying prompted the collapse of the London Gold Pool, which was established to defend the U.S. price of gold at $35 per ounce and maintain the Bretton Woods system. Central banks realized that there was not enough gold to support this system, causing the pool to collapse in 1968. However, the U.S. dollar’s peg to gold remained intact. Central banks then started exchanging their dollars for physical gold, but within three years, the United States was close to running out of gold. As a result, President Nixon closed the gold window, ending the gold standard in 1971.

United States Is Robbing The World With a Worthless Piece of Paper

Bashar Al-Assad – President of Syria

The important point to note here is that central banks were aware of the sovereign debt issue behind the dollar’s peg to gold. The dollar’s status as the global reserve currency was based on its convertibility to gold. When it became evident that the U.S. was at risk of defaulting on its gold-backed debt, central banks rushed to exchange their dollars for gold before the supply depleted. This led to a significant increase in the value of gold holdings. Now, in the present day, central banks are once again buying gold at a faster pace than they did in the late 1960s. This indicates that central banks are anticipating another sovereign debt default, not limited to the United States but also affecting governments worldwide. The immense debt levels of governments leave two options: default through inflation, reducing the purchasing power of the currency, or outright default by not repaying the owed currency. Thus, central banks are acquiring gold as a hedge against potential default and the erosion of currency value.

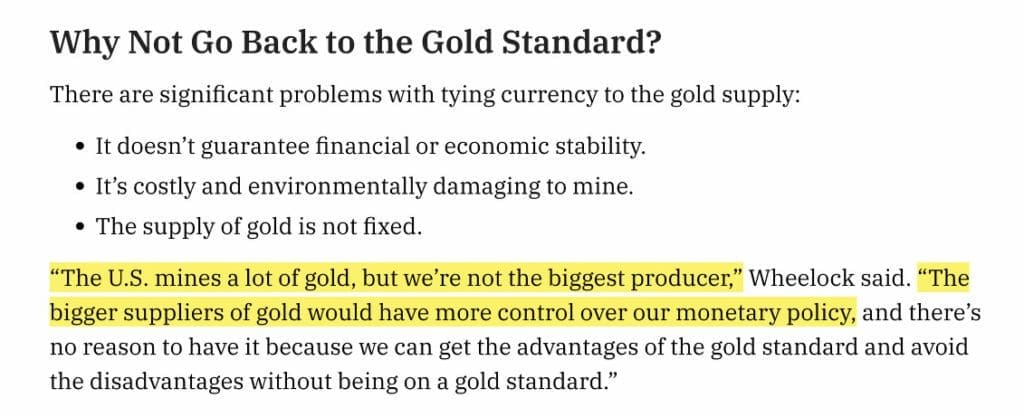

Why The US Can’t Return To The Gold Standard

The dollar is legally defined as a weight of gold (Gold price per 1 troy ounce). The US Congress has, several times in its history, altered this valuation – Franklin D. Roosevelt devalued the dollar by increasing price of gold ($ value of 1 troy ounce of Gold) from $20 up to $35. Richard Nixon again devalued the dollar by increasing price of gold from $35 to $42. This devaluation trend as of this writing is at ~$2,000 per ounce.

The US Treasury cannot buy or sell gold anymore as it would undermine the value of their fiat dollar and erode trust in the US economy, leaving their gold reserves as symbolic wealth that cannot be used for any meaningful purpose.

The US Treasury’s gold reserves have remained stagnant at 8,133 tonnes since 1980. There is too many dollars relative to physical gold reserve and revaluing gold would cause hyperinflation and loss of purchasing power: 5.3 trillion dollars of Base money (M0) circulating in the US economy divided by 261 million ounces of physical gold that the US Treasury holds, we get a price of over twenty thousand dollars an ounce. This means if the United States wants to back up the US dollar with gold, they will have to revalue the price of gold above 20 grand. Before the reset you needed just $2,000 to buy one ounce of gold, but now you need 20 grand after the reset. To buy the same physical ounce. Under the gold standard, goods, services and assets will be priced in Gold ounces so you can see how worthless the paper dollar notes are in this scenario.

Physical Gold vs. Gold ETFs (Exchange Traded Funds) vs. Gold Mining Stocks

Gold ETFs are investment options that allow you to invest in gold without physically owning gold bars or coins. They work like mutual funds or stocks, but instead of investing in companies, they track the price of gold. When you buy shares of a gold ETF, you are essentially buying a portion of the fund, which holds physical gold as its underlying asset. Gold ETFs can be a convenient and useful way to gain exposure to the price of gold, although holding physical gold is often considered the best option.

Gold mining stocks is another way to get exposure to gold markets. Gold mining stocks have the potential to offer higher returns than physical gold or gold ETFs. This is because mining companies can generate profits beyond just the increase in gold prices. Some gold mining companies pay dividends, providing additional income for investors.

Here are some points to consider regarding gold investment in general:

1. Affordability and liquidity: ETFs and Gold mining stocks allow investors to access gold without having to purchase its physical form and deal with premiums. They offer the flexibility to buy and sell shares instantly, similar to trading stocks, providing liquidity and ease of transaction.

2. Cost considerations: While physical gold may have premiums associated with it, ETFs charge management fees. Investors should compare the costs of physical gold (including premiums) with the management fees of the ETFs to determine the most cost-effective option for their investment size and goals.

3. Assessing market conditions: Comparing the price of gold to stock market indices can provide insights into relative valuations. For example, a historically high ratio may suggest that stocks are overpriced compared to gold. Investors with holding power may consider waiting for the ratio to narrow before selling gold for income-producing stocks.

4. Diversification and inflation protection: Gold serves as a diversification tool and a hedge against inflation. However, since gold does not generate income or dividends, investors may consider reallocating their gold holdings to other income-producing assets, such as real estate, if attractive opportunities arise.

Conclusion

Ultimately, the decision to invest in gold ETFs or physical gold depends on individual preferences, financial circumstances, and investment goals. It’s important to evaluate the costs, liquidity, personal objectives, market conditions, and diversification needs when considering the appropriate approach to investing in gold.

Gold is all about storing your wealth outside of the traditional fiat money system and leaving a legacy for generations to come. Consider this scenario: If your grand parents left $3,500 back in 1970 in a safe then that money can’t even buy the wheels on a car today. If they had converted that money into 100 gold coins and left them in the safe then today you would have almost $200,000 that can be used as a down payment for a new home or a Ferrari!