In our previous articles in this series, we learned about accounting fundamentals and how to practically apply those concepts using Google sheets. Now we are going to look at basic finance concepts that are very useful in your business’s day to day activities and even in the long-term planning and strategies.

First let’s take a peek at what we are going to discuss in this chapter. So, you can get a glimpse of what is heading your way.

Table of Contents

What is Finance?

First, we have to understand what is Finance and define it properly. Finance, from a business perspective is how you can raise capital and money for your business requirements and manage it properly for the growth and continuity of your business.

And from an advanced perspective, Finance means “channeling of money from surplus sources to deficit sources, or the process of channeling money from savors and investors to business and other entities that require it.”

Importance of Knowledge of Finance for a Business

Now that we know and have well-defined what finance is, as a business, let us look at why Knowledge of Finance and Financial Management is important to you.

First, Accounting and Finances are very much interrelated and depend on each other. And are equally important to your business. Why? Because these are the main methods by which you control the resources of your business. Also, it is accounting and finance that helps you to measure and take decisions.

Second, is that you must be aware of ways and channels that you can raise money for the business. You must be able to assess each source of finance and costs related with it and take the most effective way to get money for the business.

Lastly, investment is a key area for your business. Investing in healthy opportunities is vital for business success. Sound knowledge of finances help with investment analysis to make effective decision that maximise your ROI (return of investment).

Types of Finance

Now that we know what Finance is and how useful it is to us, let’s take a look at the types of Finances, or methods of Financing your business. this could be a bit challenging if you are new to the topic so stay focused.

There are 2 types of Finance. One is Equity Finance, the Other is Debt Finance.

Equity Finance

Equity financing is when you sell a portion of your business to another party and get money for it. This method could be complicated and lengthy as valuation techniques and certain legal requirements are there. Also, this method of finance is not very suitable for a small business or for a business that is still in its early stage.

To make it simpler, let’s take a look at an example. Imagine you have a company that make lemonade. As you need more funds to expand your operation, you decide to sell 20% of control of your business for $200,000. That is equity financing.

Debt Finance

Let’s take a look at the method of financing you are mostly familiar with, Debt Finance. So, what is debt finance? Simple, your Mortgage is a form of debt finance. A personal loan you may have taken is another one.

Debt finance is money that you acquire from a lending institution, such as a bank, for your business needs. Usually, you are required to provide some collateral and you have to pay it back with interest within an agreed time frame. Let’s take a popular example for this.

Imagine you are running a restaurant in the city. To build additional space for it, you need an extra $250,000. You go to the bank; you give them your proposed plan and then ask for the money.

The bank tells you that you need to provide them collateral or a security to get the amount. You place your truck as collateral with the bank and the bank lends you $250,000. Also, you will have to pay it back in monthly installments within 5 years, at an annual interest rate of 5%.

Sources of Finance

Now that we have a good understanding of Finance and what it is, let’s take a quick look at sources where you can obtain finances for your business. Below is a list of financial sources where you can get money and capital for your business.

• Love Money: Believe it or not, your Parents, family and friends are a source of funding for your business themselves! Not just that, it is one of the easiest and fastest ways to get it.

• Business Angels: as the name suggest, these angels come to your rescue when you are in need for funding. Angels are usually wealthy individuals who are looking to invest their excess cash in small businesses with a great potential.

• Venture Capitalists: These are groups/entities that are specialized in funding star-up businesses with a great potential. However, they take an equity position in the business, which means that you have to give away a percentage of control of your business to them in return for the funding.

• Banks: As always, obtaining a mortgage or a business loan from your bank in one of the most popular ways to fund your business.

Finance Concepts

Now that you know what finance is, how the process works and where to look if your business ever needs funding, let’s now try to understand some basic yet important concepts in finance that will surely help you to make prudent financial decisions.

Below are the concepts that we are going to discuss under this topic.

• Time Value of Money

Inflation

Risk and Uncertainty

Interest Rate

Devaluation of Currency

• Liquidity

• Long term and Short-Term Investments

Long Term Investments

Short Term Investments

• Asset Allocation & Diversification

• Interest

Simple Interest

Compound Interest

Time Value of Money

Time Value of Money is one of the most important concepts in finance. It says “money you have today is worth more than that same amount in the future”. Let’s take a real-life example. If I give you $100 today, and tell you to spend it on ice cream, you can do two things. You can spend it today or you can spend it later sometime in the future. Which decision will allow you to buy more ice cream? the answer is the first choice since money lose its value over time. You will be able to buy more ice creams with 100 bucks now than waiting to buy it at a future date.

Now why did that happen? Why is that spending money today on ice cream will allow you to have more ice cream than spending it later? There are several factors behind this.

- Inflation

- Risk and Uncertainty

- Interest Rate

- Devaluation of Currency

Now let’s look at each factor separately…

1. Inflation

Time value of Money has a strong connection with inflation. All your life you have gone shopping and you must have noticed that price of goods and services change over time. in fact, they increase.

“The gradual increase in the price of goods and services over time”, is the simplest and the most realistic definition we can give to define inflation. So, in our ice cream example, with time, the number of ice creams you can buy with $100 decreases because the price of ice creams goes up.

2. Risk and Uncertainty

In an economy, Risk and Uncertainty plays a vital role in deciding the value of anything. It is easy to understand that money you have and the opportunities you can spend them on at the present is more certain and low-risk than what you can do with that same amount of money in the future.

Going back to our original example, if you wait to spend your money on ice creams in the future, what would happen if they stopped making ice cream next week? Will you be able to buy ice cream then? Absolutely not.

Therefore, the value of money today is higher than the value of it tomorrow.

3. Interest Rate

Interest rate is, the amount banks pay/charge you for the money you deposit/they lend to you. so how does this affect the time value of money? Let’s take another look at our ice cream example. Rather than spending the $100 I gave you at the present, if you keep it in your packet to spend in future, what would happen?

Imagine if you put that $100 in a bank account. You get to earn an interest income. So, by keeping this $100 with you in your pocket at the present, you are actually losing earning opportunity overtime.

This is why interest rates influence the time value of money, and this is why with time, the value of money you have go down – Because having money in your pocket has an opportunity cost of not earning interest.

4. Devaluation of Currency

In any country, as the time moves on, for various reasons, governments print more money. Now what happens when the government prints more money?

You can understand that when more money is printed, money in circulation increases. What does that lead to? It means more money is now there in the economy for the same amount of goods and services. And that deceases the value of money.

Going back to our ice cream example, the value of the $100 you have decreases down over time, simply because more money is printed and the currency is devalued.

Liquidity

In the simplest of the terms, Liquidity means the ability and ease of converting an asset into cash. if an asset is Liquid, what this means is that this asset can be converted into cash relatively easily.

Let’s take an example. Imagine that you are hungry and it is the lunch time. Now you need buy and eat your lunch.

If you have money, or cash, then it is very easy for you to buy the lunch, right? you don’t have to “convert” the cash again. So it is the most liquid asset you have.

Imagine you don’t have cash in your hand and you can get the cash only after selling the inventory at your shop. Now what will happen? Obviously, you are going to miss your lunch. Why? Because it takes time and effort to convert an inventory into cash. therefore, relatively, it is not very liquid.

Long term and Short-Term Investments

Investing is one of the most important topics in Finance. In fact, the main objective of “Finance” is to help and guide businesses, investors and people to make beneficial and successful investment decisions.

Long Term investments

Long Term investments are investments that you make for a very long time. it could be 10 years, 20 years or even more than that. Typically, these assets’ value appreciates over time and brings in a stable cash flow during the period.

Here are some of the long-term investment options that are prevalent in today’s markets: Fixed deposits, Company Stocks, Long term Bonds, Mutual Funds, Investments in Real Estate,…

Short Term Investments

Short term investments refer to liquid assets that generate cash flows and can be typically converted to cash within 5 years. That means you will be selling these assets without keeping them for a long time.

Here are a few short-term investments you might be already familiar with: Certificate of Deposits (CDs), Money Market Accounts, Savings Accounts

We will discuss more about Long term and Short-term Investment vehicles in our upcoming articles.

Asset Allocation & Diversification

Asset Allocation and Diversification is one of the most important and most complex subject areas of investing. We shall be looking into it as we progress further in this article series.

Simply put, Asset Allocation and Diversification mean investing your funds in a different array of assets (such as in stocks, bonds, savings deposits, real estate, etc.) to minimize the risk of over exposure to one asset or a risk.

For an example, imagine you have $5000. If invest all of it in the stock market, and if market crashes, then what happens? You will lose all of your investment. However, if you invested $2000 in stocks, $2000 in bonds and $1000 in a high yield savings account, even if the stock market crashes, your losses will be minimum.

Interest

Here is one of the most familiar and vital concepts in Finance that you must know. Interest. When you hear the word, it is important to remember that it has two meanings depending on how it the term is used.

When you hear interest related to a bank loan, that means the amount you have to pay to the bank or to the financial institution for the money they lend you.

When you hear interest related to your savings account, or an investment, that means the amount you receive from other parties for the money they borrowed from you.

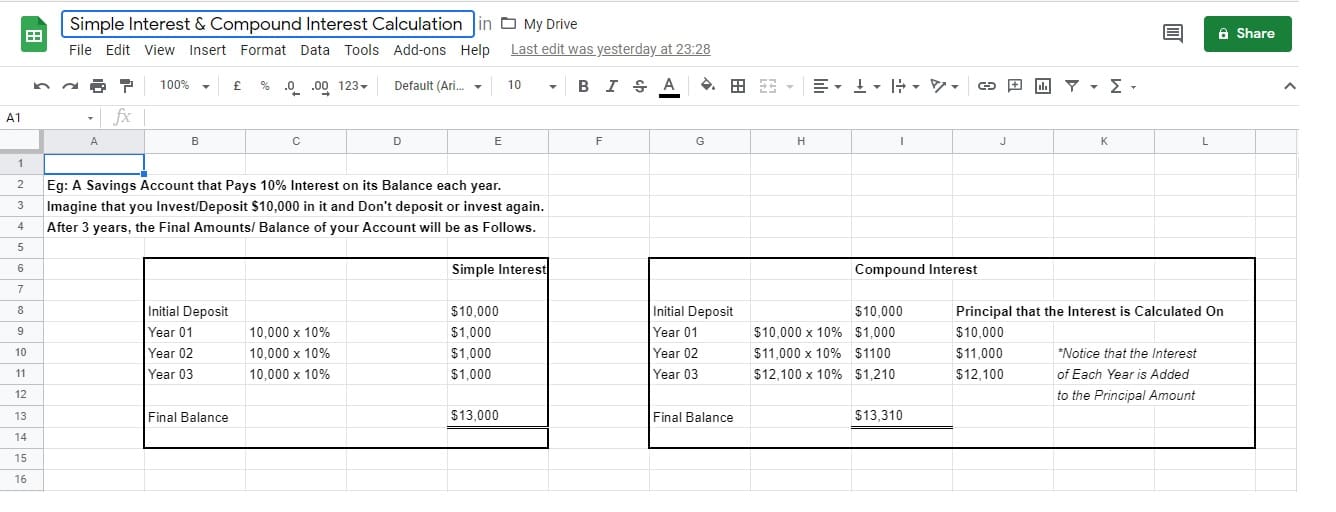

There are two methods to calculate interest. One is the Simple Interest, and the other is the Compound Interest. Let’s take a quick look at them now.

Simple Interest

Simple interest is calculated on the Principal portion of a loan or on the original contribution to a saving/investments. It is pretty straightforward and easy to calculate. Also notice that this does not “Compound”. We shall see what “Compounding” means in the next section.

Compound Interest

Here’s a little Joke. Albert Einstein once said “compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it”

So, what was he talking about? Let’s see. Compound Interest is the addition of interest to the principal amount of a loan, deposit or an investment. From another view, its is the “interest on interest”.

“So, what’s the difference?” you may ask. The difference is that in Simple Interest, you keep getting paid interest for the initial principal investment/deposit/loan amount and the interest is not added to the principal amount. However, in Compound interest, once the interest is calculated on the principal, it is added to the principal amount. So, the next time the interest is calculated, the interest is calculated on the principal amount + interest.

And that is the end of our first lesson, an introduction to the basic and fundamental concepts of Finance. In the next chapter we will explore practical financial calculations that we think are important for you as an entrepreneur.

PS: We recommend you to watch this YouTube playlist to learn more about this subject: LINK TO PLAYLIST.