The Non-Fungible Tokens (NFTs) market is developing at a rapid rate. NFTs can disrupt all sorts of industries, including gaming, gambling, and even the real estate industry. Some NFTs are already worth millions of dollars! Jack Dorsey, the CEO of Twitter, has said in a series of talks that NFTs will be bigger than Bitcoin. In fact, Jack Himself auctioned his first tweet in March 2021 for millions of dollars when he converted the proceeds to Bitcoin and donated them to charity. This article will explore what NFTs are and everything you need to know to get started with them.

‘But first, let’s run through what a smart contract is to help better understand what NFTs are and how they work.

Table of Contents

What is a Smart Contract

A smart contract is a digital agreement that allows parties to engage in business transactions using the blockchain as a decentralized database. An NFT smart contract is a protocol that follows the ERC-721 specification, which was introduced by N. Heilman in 2017. This means that the terms of the contract are clear and cannot be changed, which streamlines and secures legal agreements.

In NFTs, these contracts are called Non-Fungible Digital Assets (NFDA). NFDA have many applications beyond NFTs and can be applied to various situations such as buying an apartment or renting storage space on a secure platform such as EOS Storage.

What is a NFT (Non-fungible Token)

Non-Fungible Tokens, also known as NFTs, are digital tokens stored on the blockchain. NFTs can represent anything from a photo to an online account. They cannot be copied or counterfeited because they are stored in a decentralized ledger (the NFT’s record of ownership). Unlike cryptocurrencies, NFTs are not easily interchangeable.

How Do Non-fungible Tokens Work

NFTs work as an ownership certificate for unique digital items that owners can trade on a secondary market. They function like stocks or securities because they represent partial ownership of something and may also provide voting rights and access to dividends.

Non-Fungible Token’s primary distinction is its ability to act as verifiable proof of ownership without requiring third-party verification (e.g., bank or government).

NFTs are created with a specific purpose in mind: representing domain names, game avatars, commemorative collectibles, certificates of authenticity, etc.

What Can Non-fungible Tokens Be Used For

Some NFTs have been used most commonly where there is no intrinsic value attached to a specific item. NFTs can represent something like a game avatar or piece of digital artwork, which means that they can be traded or sold at any time.

NFTs are also used to prove ownership of more abstract items such as intellectual property rights (IPRs), shares in a company, loyalty points, etc. Owners can use them when ownership needs to be verified on a blockchain.

NFTs are likely to change how we think about transactions, assets, contracts, data storage, and more!

What Can a NFT Represent

NFTs represent anything that can be tokenized, which is practically any Digital/Physical asset. They offer a sense of authenticity and security regarding luxury goods or even real estate transactions–something like what you would expect when buying Louis Vuitton from an authorized store.

NFTs have the potential to solve many problems related to fraud and counterfeiting by providing an immutable record of ownership for various assets. NFTs could one day replace methods such as scanning QR codes with smartphones or connecting bank cards via NFC technology when purchasing anything online.

Can a Photo be a NFT? Yes! NFTs can represent anything from a photo to an online account, and they cannot be copied or counterfeited because they are stored on the blockchain. A digital artist can use nonfungible tokens as a way of selling digital artworks (digital file).

The sky is the limit when it comes to what you could create.

How Is Non-Fungible Token Different From Cryptocurrency

NFT is different from cryptocurrencies because they represent digital data (e.g., domain name) and not just currency or cryptocurrency itself. Unlike many cryptocurrencies, they also have no intrinsic value attributed to them maintaining an exchange rate with fiat money such as US Dollars or Euros.

In contrast to traditional currencies, Non-Fungible Tokens do not usually come about through any form of mining process and instead are created with a specific purpose in mind.

NFts has the potential to solve many problems related to fraud and counterfeiting by providing an immutable record of ownership for various physical and digital goods while also acting as verifiable proof of ownership without requiring any third-party verification (e.g., bank or government).

Some Popular Examples Of NFTs

Cryptokitties – Cryptokitties is an NFT representing a virtual cat that can be bred between other Non-Fungible Tokens, much like you would breed real cats.

Nefarious – Nefarious is an NFT representing the various in-game items from one of the most popular video games ever made: The Legend Of Zelda. Nefarious Non-Fungible Tokens are limited in number and can only be obtained by purchasing them from the game developers.

PepeCoin (meme) – PepeCoin is an NFT that represents the Pepe meme from 2005. The Non-Fungible Token can be bought and sold on various marketplaces (auction house) and exchanged for other cryptocurrencies such as bitcoin or ether.

CryptoPunks – CryptoPunks is an NFT representing a cartoon character. The Non-Fungible Token has no intrinsic value and can be used to trade with other game avatars, for example, on the blockchain-based MMO Virtual Reality Game called Decentraland.

Nyan Cat – Nyan Cat NFT is an NFT that draws from Nyan Cat, a YouTube viral video. Nyan Cat NFT was launched on January 28th, 2019, and sold about 120 NFTs at $30 apiece within the first hour of sales. Within 24 hours, it sold out all 1,300 NYAN tokens!

Can you create your own NFT?

Yes, non-fungible tokens can be created through a process called tokenization. Tokenizing something means taking an item and converting it into Non-Fungible Tokens representing the various fractions of ownership.

For example, if you want to create your own non-fungible token for a photo on Facebook, then there would need to be at least one NFT representing 100% of the shares/ownership to maintain control over it – essentially because someone could claim they had 51% of the stake in this situation and so have rights over what was uploaded.

You might also want more than one non-fungible token, so you don’t have all your eggs (NFTs)in one basket should anything happen with any single NFT or share.

What rights does ownership of an NFT confer? non-fungible token ownership grants the owner various rights over what they represent. This may be something like a video game, domain name, or ticket to an event and could vary depending on how Non-Fungible Tokens are designed for specific purposes.

For example, in exchange for Non-Fungible Tokens of concert tickets, maybe there would need to be a centralized verification system where only people verified as attending can enter the show, which avoids scalping/fraud.

Non-Fungible Tokens also provide an immutable record of ownership that cannot be copied or counterfeited, making them significantly more secure than traditional methods (e.g., paper certificates) used to verify ownership by third parties such as banks and governments.

Industries NFT Can Be Used In

Nonfungible tokens can be used in the following industries:

Gaming: developers use non-fungible tokens to create new games involving NFT collection and management, such as CryptoKitties. Non-fungible tokens also act as collectible cards for online games that you can trade with friends within the game itself. In-game nonfungible tokens could even be helpful outside of the game environment itself.

Governance: NFT tokens allow for decision-making without central authorities or oversight. Blockchain-based technology will enable users to vote on various issues using smart contracts via non-fungible tokens. For example, an entire country might use NDFAs to vote on what laws need to be passed, similar to democracy, except it follows an entirely decentralized system.

Real Estate: NFTs can be used to verify ownership of real estate property, similar to how NFDAs are used in nonfungible token smart contracts.

Identity: NFT tokens will likely play a significant role in various identity management systems because they can lead to better security and privacy controls for people worldwide.

Non-fungible tokens will allow users to create multiple identities on different networks without having their information leak onto another. This is known as darknet separation, which refers to keeping separate chains of nonfungible tokens that can’t be linked together. NFT tokens will also allow people to keep their identity private, which is essential for securing sensitive information such as medical records and voting data.

NFTs could even be used to identify the original creator or artist of digital art and other intellectual works.

NFT storage: Non-fungible tokens are stored in a proprietary ERC-721 smart contract on the Ethereum blockchain or various other DLT networks like EOS. NFT storage requires digital wallets and allows users to trade non-fungible tokens using an exchange protocol, making it easier to conduct business over secure digital networks.

The NFT ecosystem will likely grow significantly in coming years as more developers create new art, games, collectibles, and applications around them.

How Blockchain Technology Enable Non-fungible Tokens Creation And Transactions

Blockchain technology enables Non-Fungible Token creation and transactions by being a distributed ledger of continuously growing information, meaning it’s completely transparent to the public. This helps prevent tampering or any other malicious activity because every transaction can be seen as it happens in real-time without needing third-party verification (e.g., government).

Blockchain also provides an immutable record of ownership for various physical goods such as Non-Fungible Tokens that cannot be copied or counterfeited.

Non-fungible tokens are stored on the blockchain just like cryptocurrencies, but unlike them, Non-Fungible Tokens are not easily interchangeable. To transfer a non-fungible token from one person to another, it must typically go through some intermediary who will collect data about both owners before authorizing the transaction – a process that is much more difficult than transferring cryptocurrency between wallets.

Some solutions being developed for this problem include using smart contracts as stand-ins for third parties during transactions, enabling instant transfers of Non-Fungible Tokens without an intermediary.

How many blockchains support Nonfungible Tokens?

There are currently 3 non-fungible token blockchains,

- Ethereum NFT

- POA NFT

- EOS Storage

EOS blockchain is currently the largest non-fungible token blockchain by market cap and hosts nonfungible tokens such as EOS Knights.

The Ethereum NFT blockchain is an NFT-dedicated blockchain that supports non-fungible tokens. Ethereum NFT Blockchain powers NFTs such as Cryptokitties and Crypto Space Commander (CSC).

Popular NFT Marketplaces

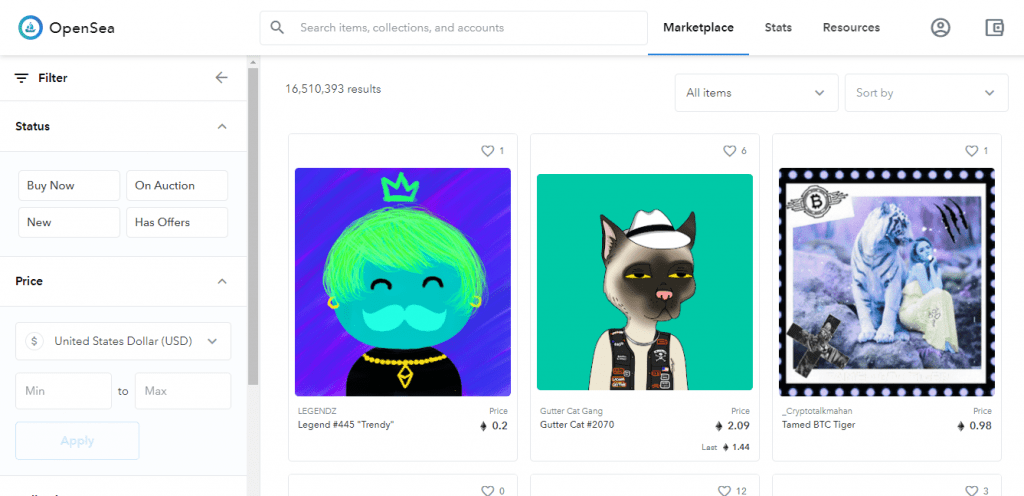

Here is a list of some popular Non-Fungible Token marketplaces you can explore,

- Nifty: Nifties are tokens that represent fractional ownership in a digital asset. Nifts can be tradeable or non-tradeable depending on the type of Non-Fungible Tokens they represent. Users can create, buy and sell their nifts via this site.

- Gnosis: Currently, only users from Europe & Asia seem to be able to access this site, but it is an opportunity for people who missed out on ICOs/NFTs created by significant companies like Telegram to get still involved with what’s going on in the space at large–some notable projects listed include Filecoin, Golem Network Token (GNT) and CryptoKitties.

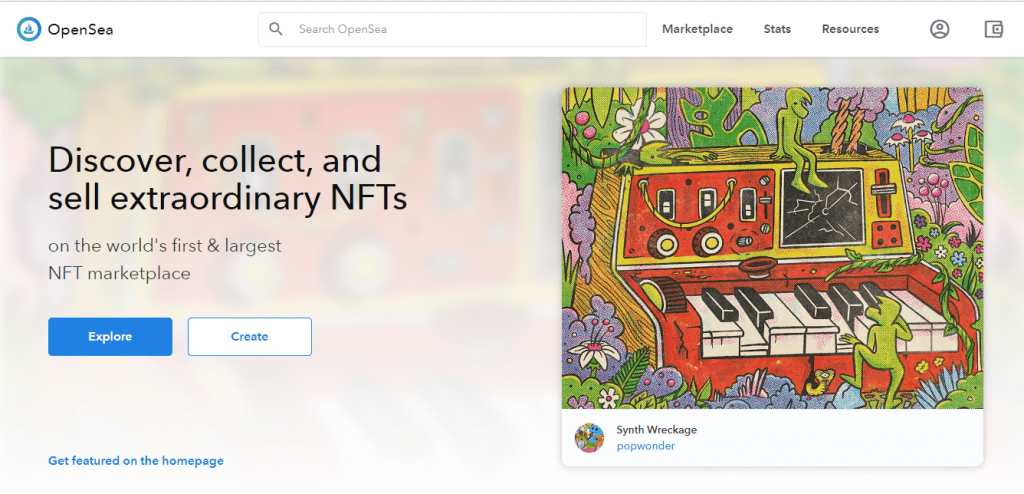

- OpenSea: This marketplace seems targeted specifically towards NFTs created for use in games and provides Non-Fungible Tokens to several different popular brands such as CryptoKitties, Databits (DTB) from the NEM project Monero.

- Raribles: This site offers Non-Fungible Tokens about various types of media–e.g., music, videos, images, or memories which can be bought or sold by users with smart contracts acting as intermediaries during transactions. The idea is that people who own Nfts on this site will have access to things like exclusive content not available anywhere else since it would only be sent if they were one of the owners.

- Decentraland: Creators can create their virtual reality environments using blockchain technology and nonfungible tokens. The Decentraland team also provides a marketplace to buy and sell virtual real estate on their platform.

How to Buy And Sell NFTs Outside The USA

Non-fungible tokens are not yet regulated by Securities and Exchange Commission in any country, but this is likely to change in the future.

Non-fungible tokens can be bought and sold on central exchanges (e.g: Coinbase) or decentralized ones like EtherDelta – but it may prove difficult for non-US citizens because of regulatory reasons.

The only way Non-Fungible Tokens can currently be purchased outside the US is by first converting your USD to Bitcoin or Ethereum on a centralized exchange like Coinbase then transferring that crypto into NFT-supporting exchanges which let the international purchase of Non-Fungible Tokens (e.g: OpenSea.io).

Quick Guide on How To Purchase an NFT from Opensea.io

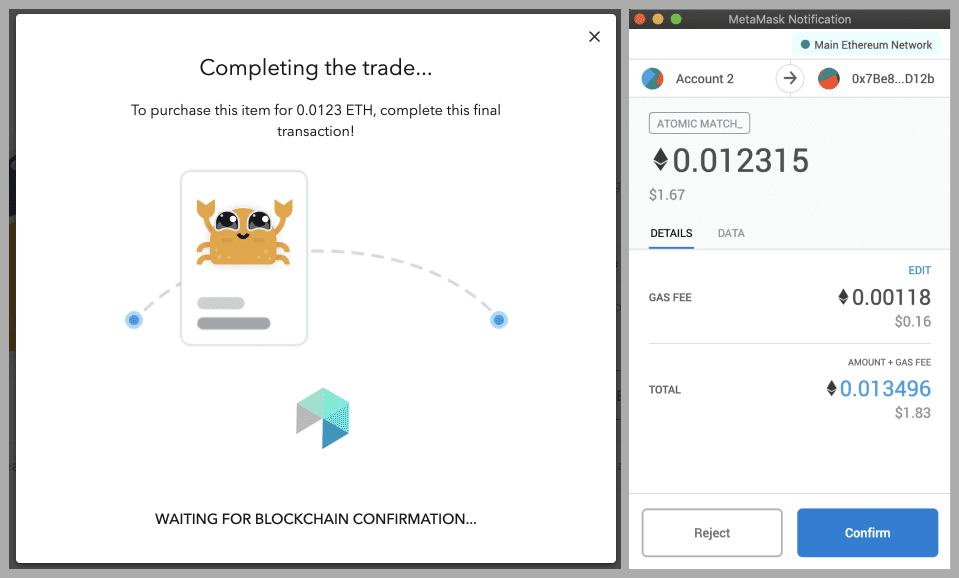

Step 1: Visit OpenSea.io and browse through catalogs of non-fungible tokens.

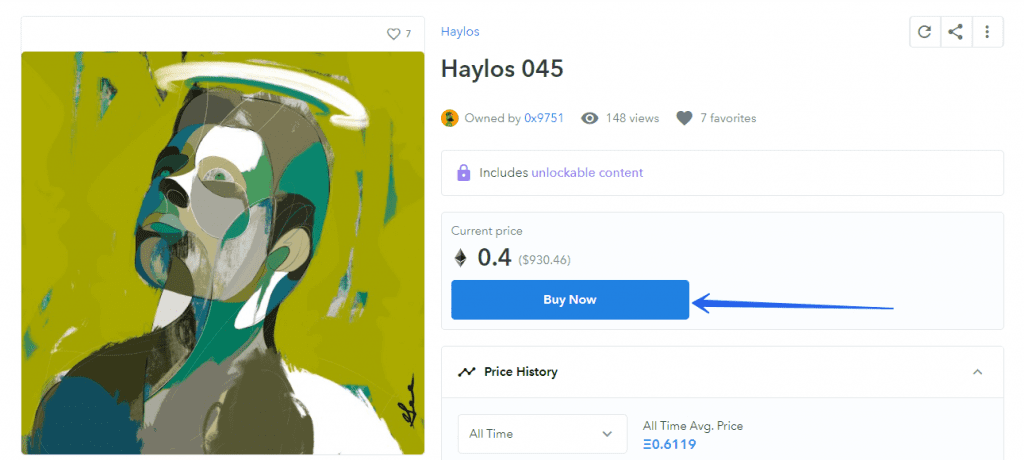

Step 2: Select a non-fungible token (Artwork) and Click “Buy Now”.

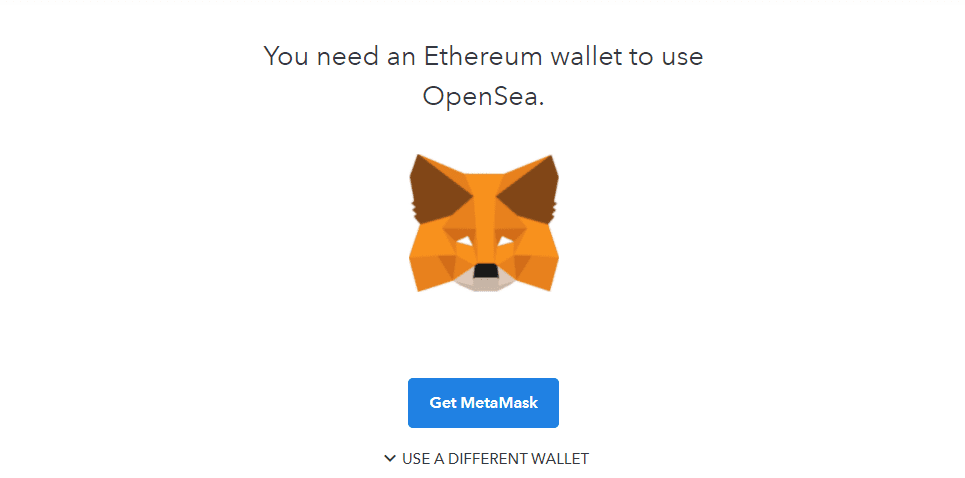

Step 3: Select an Ethereum Wallet (MetaMask).

Step 4: Complete Payment Via Checkout Page.

Once payment is processed, you will be provided access to your Non-Fungible Token listed on your Opensea.io account.

NFT Terms You Should Know:

Non-Fungible Token (NFT): non-fungible tokens are distributed on a blockchain. Unlike many cryptocurrencies, they have no intrinsic value that maintains an exchange rate with fiat money such as US Dollars or Euros.

Non-fungible tokens can represent something like a game avatar or piece of digital artwork, which means that they can be traded and sold at any time.

They are also used to prove ownership of more abstract items such as intellectual property rights (IPRs), shares in a company, loyalty points, etc.

Ledger: A ledger is the Non-Fungible Token’s record of ownership. Unlike cryptocurrencies, Non-Fungible Tokens are not easily interchangeable.

Verifiable Proof: Non-Fungible Tokens provide a verifiable and immutable record without requiring third-party verification – e.g: bank or government.

They also provide proof of ownership, which assures buyers who might otherwise want to ensure their purchases are authentic, like what you would expect when buying a luxury good from a store such as Louis Vuitton.

Tokenization: Non-Fungible Tokens can be created through a process called tokenization. Tokenizing something means taking an item and converting it into non-fungible tokens representing the various fractions of ownership.

For example, if you wanted to create your own Non-Fungible Tokens for a photo on Facebook, then there would need to be at least one non-fungible token representing 100% of the shares/ownership – essentially because someone could claim they had 51% of the stake in this situation and therefore have rights over what was uploaded.

NFT Marketplace / In-Exchange: Non-Fungible Tokens can be bought and sold on these virtual marketplaces just like any other item of property such as a car or house.

NFT Wallet: A non-fungible token digital wallet is essentially a software program or hardware device for storing and transacting Non-Fungible Tokens.

You will either have access to your NFT wallet (i.e., it’s installed directly onto your computer) or use one maintained by someone else who has been entrusted with looking after these wallets – think of them like banks or a crypto wallet for managing vast numbers of accounts for people.

Smart Contract: This term generally refers to contracts where all terms are recorded digitally and automatically executed once the contract is initiated.

Non-Fungible Tokens can represent ownership in an asset; this is what they do with the non-fungible tokens created during an ICO.

Non-Fungible Token Minting: Minting is a process of injecting Non-Fungible Token codes into (Ethereum’s) blockchain. Non-fungible tokens are generated via NFT minting and NFT sealing.

Generated Non-Fungible Tokens can be used immediately, sold on secondary markets like NIFTY or OpenSea, or transferred to other users if the Non-Fungible Token platform allows it.

The Non-Fungible Token creation code is what makes each Non-Fungible Token unique from others based on its number of decimals (a decimal is a unit in which currency can be measured).

Each block contains enough space for up to 256 digits after the decimal point – this means that there are 2,256 possible permutations of Non-Fungible Token codes on Ethereum NFT blockchain.

In all likelihood, there will not be enough Non-Fungible Token consumers to use up all non-fungible token creation codes in the NFT platform’s lifetime, which means Non-Fungible Tokens can be considered a scarce digital asset.

You can think of Non-Fungible Token minting as cryptocurrency mining but for nonfungible tokens instead of Bitcoin or Ether.

Just like miners who mine cryptocurrency in exchange for transaction fees and block rewards, NFT miners are rewarded with NFT creation codes that they may use to create their own Non-Fungible Tokens.

Non-Fungible Token Sealing: Non-Fungible Token sealing means that non-fungible tokens are being sent to another owner or NFT platform.

NFTs can be sealed by their owners or sold from one Non-Fungible Token owner to another on secondary markets.

Once non-fungible tokens have been sealed, they become non-transferable and cannot be modified without modifying the source code for the Non-Fungible Token itself.

This process of sending Non-Fungible Tokens off-chain is equivalent to you handing over your crypto assets in physical form (a book token) in exchange for cash through an online service like PayPal or Venmo.

ECDSA: The Elliptic Curve Digital Signature Algorithm is essentially what generates signatures on blockchain transactions enabling them to work securely with no chance of forgery. It doesn’t require much computing power and, more importantly, does not need mining.

NFT Nodes: Non-fungible token Nodes are the computers that store NFT information that is stored on blockchains. NFT Nodes can be run by anyone, as they do not process transaction data or carry out smart contract transactions.

NFT Nodes merely hold and manage encrypted non-fungible token data that gives specific NFT information. A user always has a copy of their personal NFTs at all times.

Conclusion

In this article, we’ve discussed the basics of what Non-Fungible tokens are and how they work. We’ve covered why these types of crypto assets have become so popular in recent years and some examples of famous Non-Fungible Tokens that exist today.

We’ve also listed some popular marketplaces for Non-Fungible Tokens and a method for buying nonfungible tokens outside the USA currently.

That’s all there is to know for a beginner regrading NFTs. In the previous article we talked about Cryptocurrency.