Blockchain, NFTs, and Cryptocurrencies are the hottest buzzwords in the internet space today. The value of Bitcoin has skyrocketed from about $1,000 per coin to more than $30,000 in a matter of few years. If you have been wondering what all the hype is around Cryptocurrency or looking for ways to make money from Cryptos, below is a beginner’s guide on investing in blockchain technology and everything you need to know about Cryptocurrencies as a beginner. Also, for our readers living outside the USA, we’ll provide you with a guide on purchasing cryptocurrency from anywhere in the world.

Table of Contents

What are Cryptocurrencies?

Before anything else, what is Cryptocurrency? As the term implies, Cryptocurrency is a digital asset designed to work as a medium of exchange using cryptography to secure transactions, verify assets and control the creation of additional units.

Cryptocurrencies are classified as a subset of digital currencies and classified as alternative currencies and virtual currencies. Cryptocurrencies are expect to replace traditional paper based Fiat currencies like Dollar and Euro in the future, specially for international trades.

How do Cryptocurrencies Work?

Cryptocurrencies use blockchain technology which was purpose-built as the accounting system for digital currency bitcoin back in 2009 by Satoshi Nakamoto (The creator of Bitcoin, the first Cryptocurrency ever created AKA Genesis block in Bitcoin blockchain).

Blockchain is a decentralized public digital ledger that records transactions in real-time across many computers, so it cannot be tampered with. It’s an evolution of P2P Torrenting system (BitTorrent). Since every record is being copied in millions of computers throughout the network the chances of data manipulation is almost impossible.

Blockchain technology has gained global recognition over the years for its transparency and immutability due to its decentralized nature. Data is stored in blocks on peer-to-peer network servers instead of being stored in one central database.

There are no central banks or governments that regulate Cryptocurrencies. In fact, Cryptocurrencies offer users anonymity, and privacy since all transactions processed using blockchain technology is encrypted.

What are the Most Popular Cryptocurrencies?

There are over 9,000 cryptocurrency types in circulation. Bitcoin (BTC) was the first cryptocurrency launched in 2009 and has been the most successful cryptocurrency so far. We call ‘Altcoins’ to all kind of cryptocurrencies that were launched after BitCoin success.

Many of the new Crypto launches aren’t going to be successful and has characteristics of pump and dump exit scams. Here are 7 cryptocurrencies that has good longevity and reputation in this space:

Bitcoin (BTC)

Bitcoin is still the king of cryptocurrency, with a market cap above 1,000 billion USD.

In 2008, bitcoin prototype was created by a developer or group of developers going under the pseudonym Satoshi Nakamoto (“Satoshi” means “clear thinking,” “wisdom” in Japanese).

The bitcoin codebase (the underlying protocol and computer language) was posted for peer review on the cryptography mailing list bitcoin-list. This email list had limited subscribers at that time, and it wasn’t widely known.

The bitcoin blockchain came into existence on January 3, 2009, with the release of the first open-source bitcoin client and the issuance of the very first units of bitcoin. This event is celebrated as bitcoin genesis.

In August 2010, bitcoin got its first real-world transaction when a programmer named Laszlo Hanyec bought two pizzas for 10,000 bitcoin. The bitcoin price at that time was around $0.008, and it rose steadily over the next three years.

The bitcoin buzz started in 2013, hitting mainstream news outlets like the New York Times, Newsweek, and The Guardian. By 2017 bitcoin had risen to almost $20,000 per coin – an incredible 400 times its value five years earlier!

This growth occurred during a period of financial crisis across Europe and uncertainty related to U.S. debt ceiling debates and currency devaluation stemmed from US sanctions in countries like Venezuela and Iran.

Bitcoin is currently trading around $30,000 per coin as of July 2021. To compare, bitcoin sold at less than one US dollar in 2011.

Altcoins

Ethereum (ETH)

Launched in 2015, Ethereum can process transactions faster than bitcoin due to its use of smart contracts and the fact that it does not have blocksize limits. Ethereum is a technology that has various practical uses such as using it as currency/exchange medium (ETH), Creation of Non-fungible tokens.

Ethereum is the second most popular cryptocurrency after bitcoin and was created by Vitalik Buterin, a Russian-Canadian programmer.

Ethereum’s basic concept builds on bitcoin: It uses blockchain technology to create an open platform for building decentralized applications (dApps).

An example of such dApp would be the Basic Attention Token that aims to improve digital advertising by promoting privacy and security.

Ethereum also has its digital currency called ether.

The bitcoin vs. bitcoin cash debate doesn’t affect ethereum much since it wasn’t born out of a bitcoin fork like bitcoin cash was.

If anything, ether is getting extra attention from bitcoin investors trying to diversify their portfolios.

Cardano (ADA)

Cardano is a relatively new cryptocurrency that came into existence in October 2017. Its founder is Charles Hoskinson, an early bitcoin developer who left the project in 2014.

Cardano aims to improve bitcoin’s blockchain technology by offering greater scalability, sustainability, and interoperability with other cryptocurrencies such as bitcoin and Ethereum.

Cardano claims it can run financial applications currently used every day by individuals, organizations, and governments worldwide. Some examples of these financial apps include payments systems, ATMs for buying bitcoin or ether with dollars or euros, credit cards, loans, or mortgages.

Cardano also aims to be a platform upon which “smart financial contracts” can be created and implemented. Smart financial contracts are bitcoin scripts that automatically execute when certain conditions defined in the script are met. For example, a bitcoin contract could include an if-then scenario for bitcoin payments like this: If you deposit bitcoin into this bitcoin address, we’ll send bitcoin to this other bitcoin address. This is much easier than dealing with lawyers or notaries who usually have to oversee similar transactions today.

Dogecoin (DOGE)

Dogecoin was created as a bitcoin parody in 2013 and has become one of the most famous cryptocurrencies.

The Dogecoin story is a delightful case study in bitcoin’s capacity to bring unlikely people together to create something new that no single person could have built alone. Additionally, it shows bitcoin users’ ability to be generous and caring towards others, even strangers.

It started with Jackson Palmer, who made the iconic doge meme and tweeted it on December 6, 2013. His tweet got retweeted more than 10k times!

Doge quickly rose in popularity among bitcoin enthusiasts. Someone even sent Palmer $1,000 worth of bitcoin for creating such a fun cryptocurrency.

Palmer and a fellow bitcoin enthusiast from Sydney, Australia, then made the Dogecoin Foundation to promote the concept of Dogecoin as a currency that owners can use for good. For example, they organized a charity drive with bitcoin users that saw them donating $30k worth of bitcoin to dig wells in Kenya.

Dogecoin is less popular than bitcoin or ethereum today, but it was pretty big during bitcoin’s early years when bitcoin’s price was still below $1,000.

Even though bitcoin has many advantages compared to Dogecoin, such as better technology and more liquidity, Dogecoin has one advantage that even bitcoin users like about it: dogecoins are more accessible to mine than bitcoins. This means you’re likely to get more dogecoins for your bitcoin than bitcoin cash.

Litecoin (LTC)

Launched in 2011, Litecoin is an open-source global payment network similar to bitcoin but with improved storage efficiency and faster processing speed.

Bitcoin Cash (BCH)

Bitcoin cash was created in 2017 due to a disagreement in the bitcoin community on how crypto transactions should be handled. It is a fork/spin-off of Bitcoin. Like all other cryptocurrencies, bitcoin cash is based on blockchain technology. It allows users to transfer funds internationally with lower transaction fees than banks in cross-border money transfer services.

Ripple (XRP)

Created by Ripple Labs Inc in 2012, Ripple is a cryptocurrency based on blockchain technology (XRP Ledger) that allows for fast and cheap international transactions.

How Are Cryptocurrency Value Determined?

A cryptocurrency’s price on the open market is determined by supply and demand: a coin type with greater acceptance will have a higher value than one with less or no approval.

Note: Some crypto companies pay their users dividends based on how many coins they own; this is called a proof-of-stake (PoS) cryptocurrency payment system. In PoS, crypto payments are made to the currency owners based on how many coins they own; an owner of a 1% stake would receive 1% of all crypto payments made.

PoS payment system is different from proof-of-work payment systems such as bitcoin cryptocurrency, where crypto payments are based on how many coins they mined or created with cryptocurrency mining computer software.

Proof-of-stake payment systems help reduce transaction fees because there is no need for miners to pay their hardware equipment owners to process cryptocurrency transactions since the blockchain network participants make crypto payments directly to one another.

How Secure Is Blockchain?

Blockchain technology is highly secure. It uses Cryptocurrency as a reward for miners who solve complex mathematical puzzles/Decrypt encrypted Crypto transactions using high-performance computers to verify transactions and maintain the ledger.

The RSA algorithm and hashing functions are used to encrypt and decrypt data later recorded on the blockchain. In other words, personal information such as your name, address, or social security number (SSN) cannot be accessed through a blockchain transaction.

Hackers can’t break into blockchain technology. This is due to the Cryptocurrency reward structure that blockchain employs. Also, Crypto mining requires a great deal of electricity and computational power. Since mining leads to high costs, it takes place mostly on specialized Crypto mining computers or in centralized mines with hundreds of miners working under one roof.

If you are interested in knowing more about how the Blockchain technology can revolutionize the information technology space then have a look at the article “Amazing applications of Blockchain technology beyond Cryptocurrency” we published in our other site.

How to Make and Receive Crypto Payments

Now that you have a basic idea about what Cryptocurrencies are and what they are used for, you’re probably wondering how to start making and receiving payments in Cryptocurrencies. there are two main ways you can achieve this:

- Peer to Peer (P2P) transfers

- Crypto Payment Processors

Peer to Peer (P2P) Transfers

In the world of cryptocurrencies, it is possible to make crypto transfers from one person to another just like with any other traditional paper based transaction medium. This made possible via Wallets and Wallet Addresses; Every Cryptocurrency requires a wallet (which acts essentially like a bank account for storing cryptocurrencies); some crypto wallet providers can support multiple cryptocurrencies and essentially allow you to store different cryptocurrencies in a single wallet.

The primary function of Crypto Wallets is to enable storing of cryptocurrencies, generating Crypto addresses for each Cryptocurrency they support to let transfers to the wallet (essentially what makes transfers possible), and allowing wallet users access to send funds. This is what makes Peer-to-Peer transfer possible; P2P essentially means person-to-person transfer or, in better terms, wallet-to-wallet transfers.

All you need is the other person’s Cryptocurrency’s address which they can generate from any crypto wallet application they are using. You can make payments directly to another business or receive crypto payments yourself.

One thing to note about Peer-To-Peer transfer, though, is the increased risk of being scammed; you have to make sure whatever you’re paying for is authentic because there is no way of recovering transferred funds.

Some popular Crypto Wallets you can use include;

- Coinbase (CoinBase.com)

- Blockchain (Blockchain.com/wallet)

- Binance (Binance.com)

- Paxful (Paxful.com)

Crypto Payment Processors

Let’s face it, P2P transfers have many drawbacks; this is especially true if you have many payments to receive or make. Not only does it require active communication with the other person, but you also have to take a lot of manual actions (copying the address, verifying transfer and transfer amount, etc).

That’s where Online Crypto Payment Processors come to play; these are essentially companies that help you collect and make crypto-related payments and without all the hassles and risks involved. You can think of an Online Crypto Payment processor as a middleman that does all the work of receiving and verifying crypto payments for a small percentage or fixed fee.

Online Crypto Payment Processors help big online and offline businesses accept crypto payments without extra staff or expertise in the crypto field. They also protect buyers by providing a secure payment environment that can not be tampered with. To get started using Crypto Payment Processors, all you need is to choose a provider and register with them.

Some notable Crypto Payment Processors include;

- BitPay (bitpay.com)

- PayPal (USA Accounts only)

- CoinBase Commerce (commerce.coinbase.com)

- CoinPayments (coinpayments.net)

How to Buy and Sell Crypto Outside the US

If you’re outside the United States, buying and selling Crypto might seem complicated, especially with all the restrictions placed for third-world countries on major crypto platforms. I.e., CoinBase. You cannot do much when it comes to certain crypto exchanges placing restrictions, but you can find alternatives.

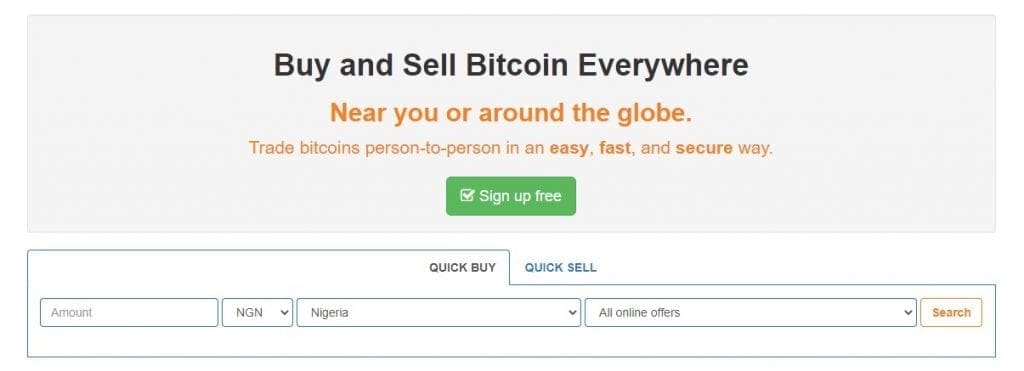

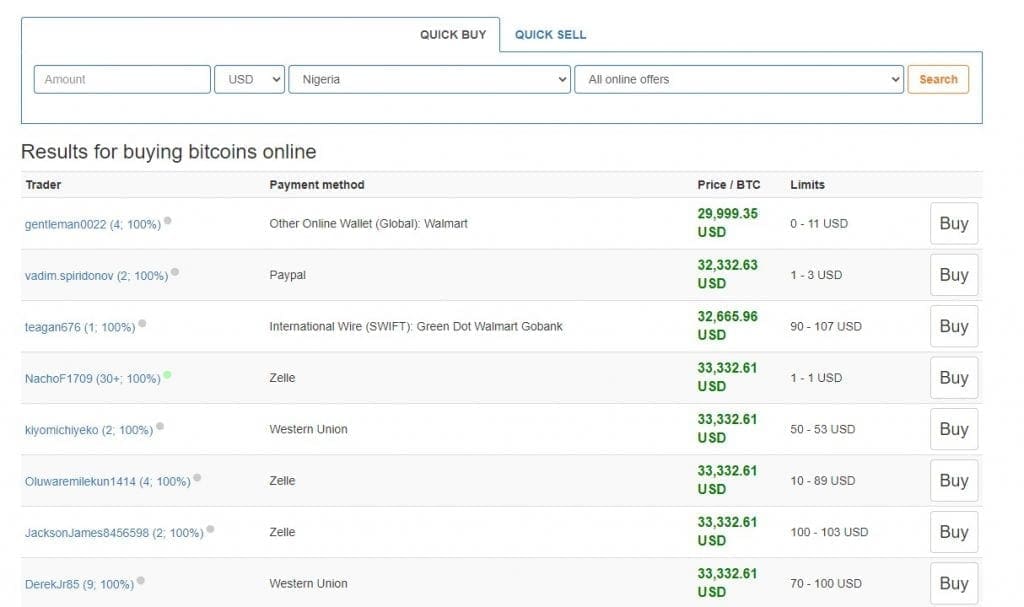

One such Exchange platform is LocalBitcoins which allows buying and selling Bitcoin no matter what country you’re from.

To buy or sell bitcoins on LocalBitcoins.com, all you have to do is:

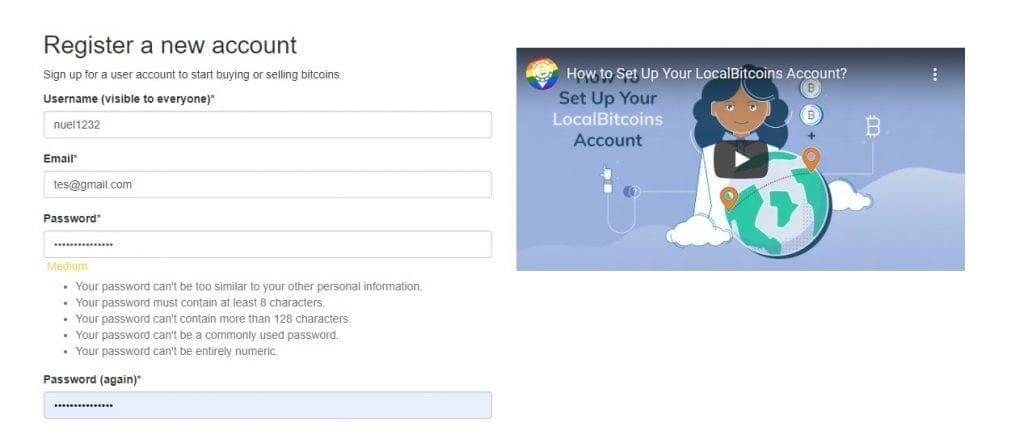

1. Create an account

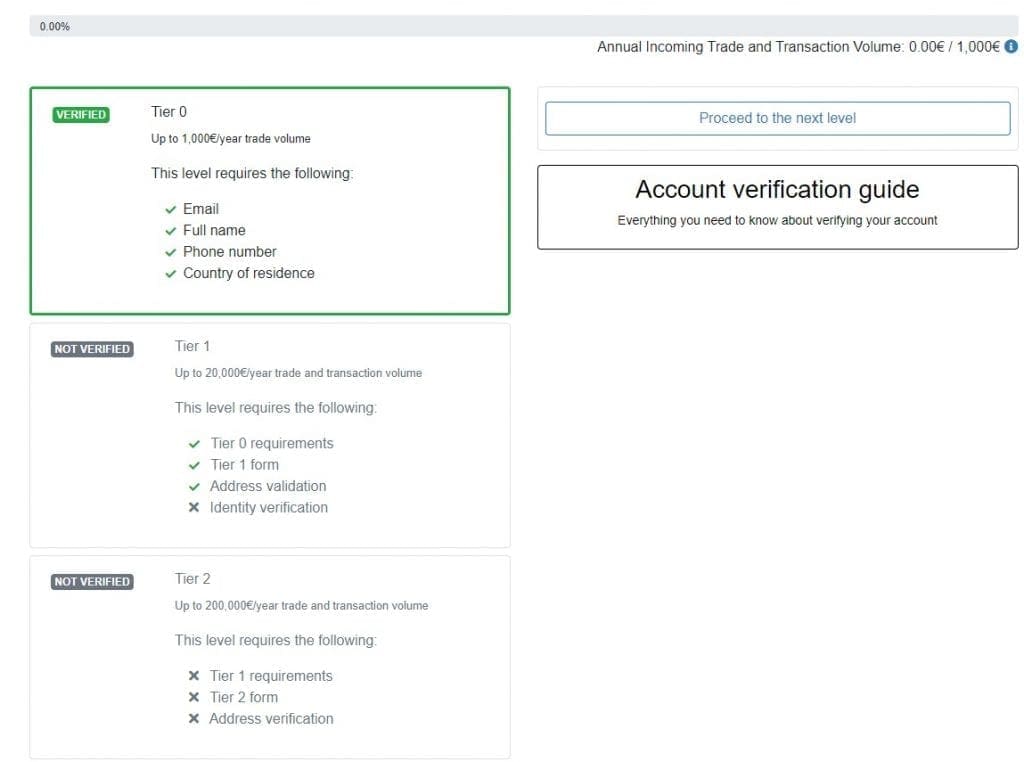

2. Submit Proof Of Identity (ID Card, Drivers License, etc.)

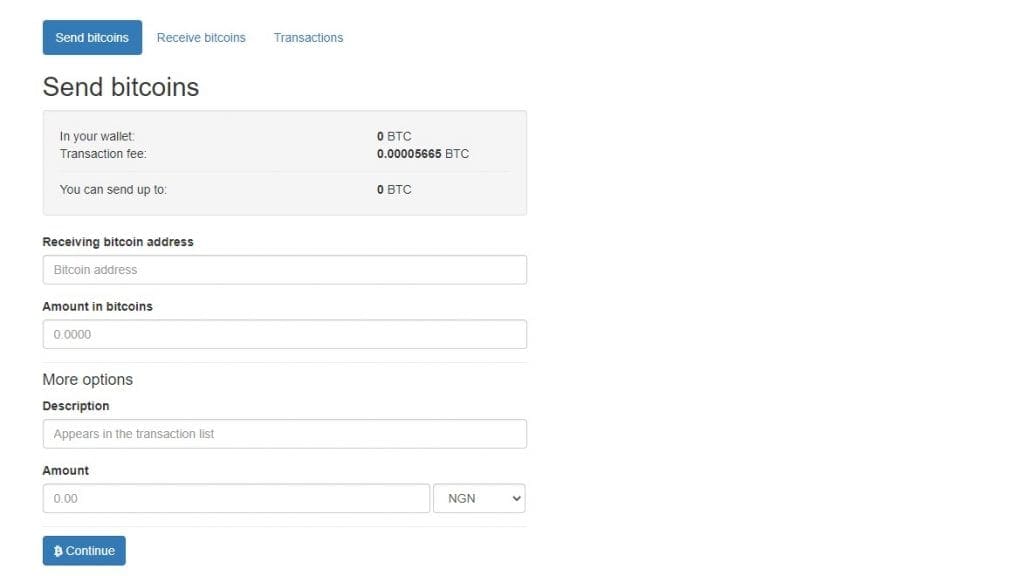

3. Deposit Bitcoin into your Wallet Or Buy from their P2P Marketplace

4. List Your Bitcoin Offer on the P2P Marketplace

5. To Buy bitcoins, browse through the Peer-To-Peer Marketplace and Select an offer with a preferred payment method

For other Cryptocurrencies, platforms like Binance provide a Peer-To-Peer marketplace feature that enables users outside the US to buy and sell Crypto.

Peer-to-Peer is virtually the primary solution to buying and selling cryptocurrencies outside the US as no restrictions can be placed on them.

Cryptocurrency Terms You Should Know

Blockchain: Blockchain technology allows you to make payments or execute purchases without an intermediary-making transactions quicker and more efficient than ever before.

Crypto Transaction: A Crypto transaction involves digital encryption keys on the blockchain network, which records all Crypto transactions in chronological order and uses complicated math problems/encryption to verify each transaction when added to the chain (or ledger).

Crypto CRASH: Crypto CRASH is a term used to describe the drop in Cryptocurrency prices when the market falls. Cryptos usually experience a CRASH after a period of high growth, followed by instability in their underlying currency values that can lead to really big losses in investment value for holders (if not handled correctly).

Crypto Mining: crypto mining involves the use of mining hardware to solve cryptocurrency algorithms/encryption and verify cryptocurrency transactions on the blockchain on behalf of cryptocurrency wallets.

The process is usually automated, but it also requires a lot of electricity. Hence, cryptocurrency miners need a robust power supply or special cryptocurrency mining rigs specifically designed to run 24/7 to recover their mining hardware cost base such as graphics processors and other mining equipment.

Cryptocurrency Miners: Crypto miners are cryptocurrency investors who don’t only purchase Cryptocurrency to hold as digital assets but also solve crypto algorithms regularly using their mining rigs to earn transaction fees from the blockchain(s) they are supporting, for example, bitcoin transactions fees which are very small (currently 0.0025 per BTC processed).

They do it because cryptocurrencies have been going up dramatically in value over time, so there is a good chance that the Cryptocurrency they earned via crypto mining will appreciate significantly over time, too, if they choose to sell at some point in the future, just like any other type of crypto investment/speculation.

Crypto coin: Crypto coin is the individual Crypto token representing a unit of account, or digital money, on its entire network. You can use these to buy goods online, make Crypto transactions, or send Crypto as gifts. For example, Bitcoin is made up of Crypto coins that are managed by Bitcoin peer-to-peer network/blockchain. Each Crypto coin has its unique encryption key that ensures the value of each Cryptocurrency.

Cryptonomics: Cryptonomics refers to using and manipulating economics with Cryptocurrency technology such as Bitcoin and Ethereum. This includes how transactions are verified and recorded using Cryptography on networks built upon blockchain technology.

Cryptocurrency Exchange: Crypto exchange allows you to buy or sell your Crypto coins with other cryptocurrencies or fiat currencies (the most popular being USD).

Bitcoin: Bitcoin is a form of digital cash that allows you to make payments without an intermediary like a bank or credit card company.

Crypto Community: Crypto Community is a group of Crypto enthusiasts from whom you can get ideas or tips about Cryptocurrency trading. You may also want to consider joining one of these online communities so that you will be able to access Cryptocurrency news updates and Crypto trading strategies that may help you become a better Crypto investor.

Crypo Wallet: A Crypto wallet is a secure software program where Cryptocurrency owners can store their coins, which allows them to manage their Crypto and facilitates the sending of Crypto with minimum effort. The Crypto wallets can be found on websites or downloaded as apps to your smartphone. The wallets are usually free for use by anyone and give you access to your Cryptocurrencies when necessary.

Cryptocurrency investing: Crypto can be used either as a transaction medium or an asset. Investing in crypto essentially means buying currency at low prices and selling them when their value rises significantly. Investing is not limited to trading though, as cryptocurrency can come from many sources- mining crypto coins or tokens, running master nodes or even giving away free coins by hosting ICOs (Initial Coin Offerings).

Crypto News: Crypto news updates allow you to stay on top of what is happening with your favorite form of Cryptocurrency so that you can make better Crypto trading decisions for yourself. Crypto news can be found on many popular online sites or Crypto news outlets, including CoinDesk, Investopedia, and The Merkle.

Cryptocurrency Price: Cryptocurrency prices are determined by market forces, which means that the value of a Crypto coin will be whatever people on the Crypto market agree to trade it for at any time. This is why you need to keep up with Crypto news to know whether there is good news about a Cryptocurrency that could drive its price up (Time to Hold) or terrible news which might result in its price crash (Time to Sell). The Crypto markets update continuously as new information becomes available.

Crypto Calculator: Crypto calculators are designed by coders so that they will allow you to understand how much money your Crypto holding is worth in terms of real-world currency. Most Crypto calculators provide you with a total figure, but some do not; it’s important to ensure that you check whether the one you choose provides you with this information or not before you start Crypto trading.

Crypto Debit Card: Crypto debit cards are pre-paid Crypto cards that allow Crypto owners to access their Crypto by inserting the card into a Crypto ATM and selecting ‘cash withdrawal.’ This is often much easier than accessing your Crypto using your computer or smartphone and maybe faster, too.

You can even send Crypto directly from your DEBIT CARD to another individual’s debit card in just a few seconds, but only if they also have one of these cards and both accounts are registered on the network supporting the card.

P2P Trading: P2P trading companies allow Crypto owners to trade their Crypto online even if the exchange rate of that particular Crypto isn’t excellent. To do this, you place a bid just like you would on eBay and wait for someone to come along and accept your price.

It’s essential to ensure that the company is legitimate because there are plenty of scam companies out there who will take advantage of inexperienced Crypto investors by stealing their Cryptocurrency from them or laundering their money for them without first receiving payment in full.

Crypto Address: Crypto addresses are wallet addresses that allow Crypto owners to send Crypto coins over the Internet when paying for Cryptocurrency.

Crypto address should always start with either a ‘1’ or an ‘L’ (e.g., L3MmRoRKYYhTNGq9wVt3s6vCkWg7TQKhv).

Altcoins: Crypto alternatives are Cryptocurrency that have come out after Bitcoin and work similarly. For example, Litecoin is designed to have a faster Crypto processing speed than Bitcoin does, which means it will be popular with those Crypto fans who worry about transaction times when sending Crypto payments over the Internet.

Blockchain: Crypto blockchains are Crypto ledgers that allow Crypto transactions to be recorded safely and securely without requiring Crypto owners to go through a exchange.

These Crypto ledgers are databases that store records of all completed Crypto transactions, including the date and time they were sent, who sent what to whom, and the amount of each transaction.

Decentralized finance (DeFi): Crypto isn’t just limited to payments. Crypto technology also removes the necessity of central controlling authority. It allows people who want to make Crypto payments without using a third-party service (PayPal, Stripe,…), which provides users with peace of mind that their money is safe. The term Defi means ‘no middleman.’

Crypto fiat: Crypto fiat is Cryptocurrency that a government or central bank has issued. Crypto was initially designed to remove the need for traditional paper based Fiat currency to purchase goods and services.

These days, there are Crypto ATMs all over the world that allow you to swap your Crypto for Crypto fiat, which many people prefer because they can then spend their money as soon as they receive it and don’t have to wait days before making an exchange on the Internet.

FOMO: Fear of Missing Out means not being able to afford to buy packs of Cryptocurrency at a specific price when you see others doing so. With Crypto, the fear of missing out means worrying about Crypto prices rising and being unable to buy Crypto while still affordable.

FUD: Fear, Uncertainty, and Doubt refer to negative Crypto news that causes Cryptocurrency prices to drop suddenly. Crypto experts often use phrases such as ‘don’t invest more than you can afford’ to Crypto investors not to panic and sell their Cryptocurrency in a ‘FUD’ ‘selling panic lose’ or ‘this too shall pass’.

Decentralized applications (DApps): DApps allow Crypto owners to use Crypto technology to buy Cryptocurrency or sell it directly to one another through their smartphones, allowing them to take advantage of peer-to-peer trading while on the move. These types of Crypto apps have already begun changing the way we trade Crypto today, and many more will come out as time goes on.

Initial Coin Offering (ICO): ICOs allow Crypto start-ups to raise Crypto capital by offering early investors Cryptocurrency in return for money.

These Crypto offerings are designed to help the companies behind them develop new products. Still, there have been cases where Crypto scammers have used ICOs to steal Crypto from amateur investors who aren’t aware of the changes.

Non-fungible tokens (NFTs): NFTs are Crypto tokens that cannot be exchanged for a different Crypto token or Cryptocurrency.

Think of them as Crypto collectibles where each one is unique in some way. For example, an individual Crypto might be rarer than others; they might have been the result of a successful Crypto crowd-sale and will therefore hold extra value if the associated crowdfund is booming, etc.

Proof of Authority (PoA): Crypto PoA works by mining pools, only allowing Crypto miners with a Cryptocurrency identity to use their Crypto hash power. These Crypto identities must be verified so that there is no way around the blockchains while using them for Crypto energy consumption. The process of verification means that this method of managed Crypto mining is slower than other types of mining on blockchain technology.

Proof of Stake (PoS): PoS systems are designed to make Crypto transactions more secure and let investors to earn more Cryptocurrency without consuming as much electricity. In this type of blockchains miners don’t do Crypto verification work but instead requires them to put their cryptocurrencies at stake.

For a Crypto miner to have their Crypto block verified by the network, they must show that they own an amount of Cryptocurrency proportionate with the number of Crypto blocks they want to be confirmed.

Proof of Work (PoW): PoW is the name given to any blockchain technology that uses Crypto mining as a way of keeping transactions secure and proving the creators are authorized users. It involves using special software on powerful computers to Crypto mine on the blockchain.

As Crypto mining has become competitive and there’s only small number of coins to be mined, this mining process has started using more and more energy. Crypto mining centers often require a lot of electricity which means they aren’t always as green or renewable as they could be and are therefore an environmentally unfriendly.

Smart (financial) Contracts: Smart Crypto contracts are self-executing agreements that have been programmed into the Crypto blockchain and only unlock funds when all of the terms in the Crypto contract have been met.

A prime example of a Crypto smart contract is when an individual sends crypto to another person upon receiving their face being verified as genuine via a webcam using biometrics.

This type of Crypto transaction can be made fully automated by placing it on a blockchain to execute itself without any human intervention whenever the conditions of the Crypto contract are met.

Whale: Cryptocurrency investors with a lot of money at their disposal. They can make or break Crypto prices by simply moving around the Crypto market, and they also have access to special Cryptocurrency trading tools that other investors don’t.

That’s all there is to know for a beginner regrading Cryptocurrency. In the next article we talk about Non-fungible tokens (NFTs).